Links worth investing in: Stable coins, geothermal energy and top performing investment trusts in H1 25

Further reading for the weekend, including some AI follow ups and some worrying factoids on the UK

This letter is free for all subscribers this week, thanks to The Wealth Club….

Sponsored Content from The Wealth Club: Invest like the super-rich - free guide

It’s been touted as the "best party in town you never get invited to". The rich have been using Private Equity to grow their wealth for years. And overall, Private Equity has outperformed global stock markets over the past 25 years, although that's not a guide to the future. However, until recently it was strictly off-limits to private investors, unless you had tens of millions to spare.

Fortunately, that’s changing - the doors to Private Equity are being pushed open. This free guide from Wealth Club tells you what Private Equity is, how it works, what the risks are… and how you could invest from just £10,000.

Download it here.

AI update - Worth watching: How to Get the Most Out of LLMs

Many of you found the AI summary from last week useful, so I thought I might continue with that theme and suggest two practical follow-ups. The first is the excellent commentator Ian Leslie, whose newsletter is well worth subscribing to. He’s been wrestling with the practical issues surrounding AI – who wins, who loses and how to use it – and he’s been running a great podcast with AI expert Jasmine Sun, which is well worth listening to/watching. In fact, he’s done two, although the second one is more practical. The hitch is that you need a subscription to Ian’s SubStack, but I rate it highly…

Listen HERE

Sticking with the practical side of AI, I’d also thoroughly recommend Ethan Mollick at One Useful Thing, who is, in my view at least, the single best commentator on how to use AI. He’s been writing about this for years now (he’s a leading business academic) and one of his latest letters has some great practical advice… summarised below.

It used to be that the details of your prompts mattered a lot, but the most recent AI models I suggested can often figure out what you want without the need for complex prompts. As a result, many of the tips and tricks you see online for prompting are no longer as important for most people. At the Generative AI Lab at Wharton, we have been trying to examine prompting techniques in a scientific manner, and our research has shown, for example, that being polite to AI doesn’t seem to make a big difference in output quality overall¹. So just approach the AI conversationally rather than getting too worried about saying exactly the right thing.

That doesn’t mean that there is no art to prompting. If you are building a prompt for other people to use, it can take real skill to build something that works repeatedly. But for most people you can get started by keeping just a few things in mind:

Give the AI context to work with. Most AI models only know basic user information and the information in the current chat, they do not remember or learn about you beyond that. So you need to provide the AI with context: documents, images, PowerPoints, or even just an introductory paragraph about yourself can help - use the file option to upload files and images whenever you need. The AIs can do some of these ChatGPT and Claude can access your files and mailbox if you let them, and Gemini can access your Gmail, so you can ask them to look up relevant context automatically as well, though I prefer to give the context manually.

Be really clear about what you want. Don’t say “Write me a marketing email,” instead go with “I'm launching a B2B SaaS product for small law firms. Write a cold outreach email that addresses their specific pain points around document management. Here's the details of the product: [paste]” Or ask the AI to ask you questions to help you clarify what you want.

Give it step-by-step directions. Our research found this approach, called Chain-of-Thought prompting, no longer improves answer quality as much as it used to. But even if it doesn’t help that much, it can make it easier to figure out why the AI came up with a particular answer.

Ask for a lot of things. The AI doesn’t get tired or resentful. Ask for 50 ideas instead of 10, or thirty options to improve a sentence. Then push the AI to expand on the things you like.

Use branching to explore alternatives. Claude, ChatGPT, and Gemini all let you edit prompts after you have gotten an answer. This creates a new “branch” of the conversation. You can move between branches by using the arrows that appear after you have edited an answer. It is a good way to learn how your prompts impact the conversation

Troubleshooting

I also have seen some fairly common areas where people get into trouble:

Hallucinations: In some ways, hallucinations are far less of a concern than they used to be, as AI has improved and newer AI models are better at not hallucinating. However, no matter how good the AI is, it will still make errors and mistakes and still give you confident answers where it is wrong. They also can hallucinate about their own capabilities and actions. Answers are more likely to be right when they come from the bigger, slower models, and if the AI did web searches. The risk of hallucination is why I always recommend using AI for topics you understand until you have a sense for their capabilities and issues.

Not Magic: You should remember that the best AIs can perform at the level of a very smart person on some tasks, but current models cannot provide miraculous insights beyond human understanding. If the AI seems like it did something truly impossible, it is probably not actually doing that thing but pretending it did. Similarly, AI can seem incredibly insightful when asked about personal issues, but you should always take these insights with a grain of salt.

Two Way Conversation: You want to engage the AI in a back-and-forth interaction. Don’t just ask for a response, push the AI and question it.

Checking for Errors: The AI doesn’t know “why” it did something, so asking it to explain its logic will not get you anywhere. However, if you find issues, the thinking trace of AI models can be helpful. If you click “show thinking” you can find out what the model was doing before giving you an answer. This is not always 100% accurate (you are actually getting a summary of the thinking) but is a good place to start

Your Next Hour

So now you know where to start. First, pick a system and resign yourself to paying the $20 (the free versions are demos, not tools). Then immediately test three things on real work: First, switch to the powerful model and give it a complex challenge from your actual job with full context and have an interactive back and forth discussion. Ask it for a specific output like a document or program or diagram and ask for changes until you get a result you are happy with. Second, try Deep Research on a question where you need comprehensive information, maybe competitive analysis, gift ideas for someone specific, or a technical deep dive. Third, experiment with voice mode while doing something else — cooking, walking, commuting — and see how it changes your ability to think through problems.

Most people use AI like Google at first: quick questions, no context, default settings. You now know better. Give it documents to analyze, ask for exhaustive options, use branching to explore alternatives, experiment with different outcomes. The difference between casual users and power users isn't prompting skill (that comes with experience); it's knowing these features exist and using them on real work.

Worth looking at : Star Wars fans will love this celestial map

“Very happy to share that we’ve restored the cartography page on starwars.com that was originally developed for The Essential Atlas. You’ll find a revised galaxy map (based on the wonderful 2021 Star Wars Celebration poster map and designed by DK) and a new appendix of star systems that incorporates thousands of worlds from new canon.” Appendix isn’t quite the right word; it’s a 59-page gazetteer (PDF). Despite the page basically being a scrolling interface for a static map in JPEG format, it’s being positioned as a living document: Jason says the map will receive updates and error corrections (worlds from some of the most recent series aren’t necessarily up yet). His post lists the changes to the map since 2021.”

Factoids

British Troubles 1: The IPO problem. The FT reports that in the first half of this year, IPO fundraising in London hit just £160 million, the lowest level in 30 years and 98% down from the 2021 peak.

British Troubles 2: the FDI problem. New figures from the Department for Business and Trade show a 12% year-on-year decline in the number of Foreign Direct Investment (FDI) projects landing in the UK, falling to just 1,375 in 2024–2025. This marks the lowest number of FDI projects since 2020 and raises fresh concerns about the UK’s international competitiveness. The downturn has affected nearly every region and sector, with the total number of FDI-backed projects now at its lowest level in five years.

Kiwi scientists accidentally cut cow manure emissions by 90%. Researchers discovered that adding polyferric sulfate, a chemical that's widely used in wastewater treatment, cuts methane emissions by up to 90%. The innovation is now being rolled out across 250 farms, and has the potential to ultimately reduce New Zealand’s dairy farm emissions by between 7% and 9%. Bloomberg

We’ve only mapped 27.3% of the seabed. The Seabed 2030 project announced on Saturday that “27.3% of the world’s ocean floor has now been mapped to modern standards. The increase in data represents more than four million square kilometres of newly mapped seafloor—an area roughly equivalent to the entire Indian subcontinent.” Data compiled by this project is freely available via GEBCO’s global grid.

Résumé deluge. Recruiters have seen a 45% surge in AI-generated résumés this year – it's reported that they receive an unprecedented 11,000 submissions per minute.

Most active stocks on the global Interactive Brokers dealing platform: TSLA, Tesla, is the most active name at IBKR. Close on the heels of #1 TSLA in both gross and net stock activity was #2 CRCL. That stock leapt past the prior perpetual runner-up, now #3 NVDA, during its post-IPO moonshot. IBKR saw robust buying during the stellar rally, but this week’s report shows even more buying as the stock gave up about 1/3 of its recent peak. IBKR reports that

“Quite frankly, it is much easier to understand the desire for traders to buy dips in a name like TSLA, which has a long track record of rewarding faithful investors, than it is for an eye-wateringly volatile stock that has been public for less than a month. Such is the mentality among fearless traders these days. The crazy stock of the week is #9 CYN. In recent days it shot from $4 to $41 and closed yesterday at $14.40. Bear in mind, this stock’s 1-year high was $1600 after adjusting for reverse splits. I recently joked that our customers’ love of highly speculative highly volatility was not yet a full-fledged “flight to crap”, but it is clear that the motivation behind many of these stocks’ activity was something other than disciplined considerations of discounted cash flows.”

Interactive Brokers’ 25 Most Active Symbol List Ranked by Client Orders –1/7/2025

Ten best performing investment trusts H1 2025

Source: theaic.co.uk / Morningstar. Share price total return in % to 30/06/25. N/A means there is no performance history for this period. Ordinary share classes only. Excludes VCTs and companies undergoing liquidation. * Indicates the company is subject to a bid.

British Troubles 3: The UK SME Export problem

Just 9% of the UK’s SMEs export, lagging behind all the countries in the G7. A Social Market Foundation paper sets out how Britain can catch up: by overhauling export support so SMEs get the finance, mentoring and market advice they need; cutting trade costs like VAT complexity, tariffs and customs red tape; and cracking down on online risks like counterfeiting and VAT fraud. There’s no silver bullet, but small, targeted reforms across these areas can unlock big gains. Proposals include a new SME-friendly UKEF offer, more overseas trade advisers, and a proper “one-stop shop” for exporting help. A previous report demonstrated that increasing the number of SMEs exporting goods by 70k could add £9.3bn to national income each year and create 152k additional jobs.

Caution on drones

Like many observers, I tend to get a bit breathless when reporting on drones and their use on the frontline in Ukraine. Rather like AI, there’s a temptation to get a bit carried away and think that all wars will be aerial and automated while forgetting that you still need legacy military technology and, frankly, logistics and ammo! A very useful corrective comes from the venerated strategist Sir Lawrence Freedman in one of his recent letters on the nature of drone war – starting with developments in Ukraine.

“In an analysis of last year’s warfare for RUSI, Jack Watling and Nick Reynolds explain why context must be kept in mind when talking about drones. Drone operations can be affected by the weather, jamming, and the difficulty of mounting complex operations with multiple vehicles. They note that between 60% and 80% of Ukrainian FPV drones failed to reach their targets, and if their targets were armoured vehicles they were often not destroyed. They were still accounting for 60–70% of damaged and destroyed Russian systems, with enemy infantry suffering the most, but that reflected shortages of other forms of firepower, and in particular artillery, as much as the superior quality of drones. They cite Ukrainian officers emphasising that:

‘UAVs alone were inadequate and that they were most effective when used in combination with artillery. For example, artillery was effective at suppressing or displacing EW [electronic warfare] and air defences or suppressing infantry protecting key targets from bomber UAVs. Artillery was also able to defend the front in poor weather and was generally more responsive. Combined UAV and artillery operations often maximised the destruction achieved with, for example, an FPV immobilising a vehicle and artillery killing dismounts as they emerged.’

Although these combined strikes were most effective, Ukrainian officers noted that they were rarely able to achieve this effect because of a scarcity of artillery.

A similar, though even more sceptical verdict, comes from Jakub Jajcay, until recently a member of a Ukrainian FPV drone team. Often their apparent successes involved no more than hitting targets that had already been hit by other systems, such as a mortar or a munition dropped from a re-usable drone. They were ‘finicky, unreliable, hard to use, and susceptible to electronic interference’, and most lacked a night-vision capability. Not enough time was spent training the operators. While FPV drones were relatively cheap ($500 a sortie) a mortar shell or a grenade dropped from a reusable drone was cheaper ($100), and mortars, like artillery, ‘can’t be stopped by bad weather, jamming, or crowded frequencies. Nor can they be impeded by the dark.’ But this restates the problem. Ukraine didn’t have enough artillery pieces and ammunition so drones filled a gap.

The point is not that FPV drones are better than classical forms of firepower - they are just more available. More of the classic forms and they play less of a role. The most transformational aspect of drones may turn out to be the close surveillance of the front lines. The resultant transparency is what makes it hard for enemy forces to advance without being seen and then struck. But drones cannot win wars on their own and have not rendered armoured vehicles, let alone artillery, obsolete. Their value grows the more they can be integrated with other systems.”

More HERE

Geothermal Heat: The Next Big Opportunity

I’ve long been of the view that the next great ‘almost there’ big thing in energy is geothermal energy. I know there have been a few attempts at launching a geothermal energy investment trust, which didn’t come to fruition. And of course, there’s a little less enthusiasm in the UK because we are not a huge ‘hot spot’ apart from in Cornwall!

I still think curious types should keep an eye on this space, and one excellent introduction comes courtesy of my favourite environmentalist, Hannah Ritchie, in her Sustainability by Numbers letter, available for free here.

Geothermal for electricity production

In this process, we generate electricity by turning a turbine using steam. Of course, to get steam we need extremely high temperatures. That’s why geothermal resources for electricity tend to come from extremely hot (well over 100°C) reservoirs, deeper in the ground (often several kilometres deep). In some cases, this steam can come directly from these reservoirs. In other cases, very hot water is depressurised at the surface to then make steam.

Since we need high temperatures, the suitable locations for geothermal power are much more limited than for direct heat. The ideal locations tend to cluster around the edges of tectonic plates; as we’ll see later, countries along the “Ring of Fire” — a series of volcanoes that stretch from South-East Asia, up and around the West Americas, down to South America — have the most potential.

I think this is an important misconception: we imagine that we can use the heat beneath our feet to generate electricity anywhere. In reality, large parts of the world can’t do this with current technologies.

Source: BBC Science Focus

Summary of the different types of geothermal

This schematic is pretty nice at capturing the different types. You can get heat for ground-source heat pumps at shallow depths (and lower temperatures). You can get more heat for district heating schemes or industry if you dig deeper. And finally, you can generate electricity if you can tap into even deeper — and hotter — sources, typically well over 100°C.

Source: UK Government Office for Science

How much of the world’s electricity comes from geothermal?

The bit that I think people find most interesting is geothermal for electricity. We’re going to need a lot of low-carbon electricity if we’re to not only decarbonise our existing grids, but also electrify transport, heating, industry, and meet growing demand for data centres and air conditioning.

In principle, geothermal energy could be an essential part of the mix, especially as it doesn’t suffer from the variability of solar and wind. It could provide a nice, stable grounding that reduces our need for storage or other options to balance out “intermittency.”

But so far, it has had very little impact. The chart below shows how the installed capacity of geothermal has changed since 2000. Now, if we assume the capacity factor — basically the amount of time that the plants are running — for geothermal is around 75% (which seems reasonable given the literature and estimates for the US) then I estimate that it globally we got around 97 terawatt-hours (TWh) of power from geothermal in 2023.¹

For context, the world produced around 30,000 TWh of electricity in 2023, so geothermal was just 0.3% of the total.² Not that impressive, and not really changing much over time.

Which countries can generate electricity from geothermal, and which of them do?

One common misunderstanding — which I also failed to appreciate in the past — is that geothermal can’t be used for electricity production everywhere. There’s maybe the naive message that every country has all of this heat beneath its feet and that can be easily used to run their electricity grids.

But as we saw earlier, to produce electricity, you need higher temperatures, which aren’t available everywhere at a depth that is currently reachable. Dig deep enough and you’ll hit rocks that are hot enough, but in most locations, this is just too far.

This is reflected in where geothermal power has already been tapped into, and limits the potential for every country to use it.

The maps below show, first, the countries that already have installed geothermal power capacity. The second shows where the highest geothermal potential is: mostly along active tectonic zones.

The highest potential is along the West coast of the Americas, East Coast of Africa, and South-East Asia. That’s why we see countries like the US, Indonesia, the Philippines, Mexico and Turkey leading the way.

Kenya is another interesting example: I estimate that it gets around 45% to 50% of its electricity from geothermal.³ The caveat is that levels of energy poverty are high, so the conclusion that countries can easily run most of their grids on geothermal — while maintaining high standards of living — would be a stretch based on this example alone.

Source: IRENA via Our World in Data

Source: Elders and Moore (2016). Geology of geothermal resources.

Stable Coins: the future?

I’ve always thought that the crypto market was a solution searching for a question: all it needed was to find a practical, scalable product. Bitcoin has increasingly emerged as a digital form of gold, particularly for individuals in the developing world.

Blockchain is quietly gaining momentum and beginning to find numerous real-world applications.

And then there’s stablecoins. Again, I can see the uses of stable coins, it’s just that I was never much of a fan of Tether, the first big stable coin widely used. In reality, stable coins are, in my view, a new form of privatised central banking. There’s nothing wrong with that model; it’s just that you have to trust the people running the private central bank (which I tend not to).

All of which brings us to the Circle IPO. The CryptoSlate website reports that:

“Circle’s stock (CRCL) has dramatically outperformed Bitcoin since its June 5 listing on the New York Stock Exchange. According to data shared by former BitMEX CEO Arthur Hayes, CRCL has surged nearly 472% relative to Bitcoin when indexed to its IPO date. The rally comes as Circle’s share price jumped from its $31 IPO price to almost $200, lifting its market valuation to roughly $45 billion. This performance reflects growing investor confidence in the stablecoin issuer, especially following favourable regulatory developments in the US. Mid-June marked a turning point for CRCL after the US Senate approved the GENIUS Act. The legislation proposes a federal framework for US dollar-backed stablecoins, potentially providing regulatory clarity that could benefit firms like Circle, the issuer of the USDC stablecoin.”

There’s lots of excitement about Circle and Stable Coins – I’m trying desperately hard to restrain my natural scepticism. Something important does seem to be happening and the Trump circle seems keen to promote it (which obviously is its own red flag).

One practical and sensible guide through the maze of stablecoins is Rahul Bhushan’s excellent On the Pulse letter. Rahul is at Ark Invest in the UK.

His killer line ? “the dollar is no longer just the dollar. It’s software.”

“Behind the scenes, several major firms are now said to be exploring stablecoin issuance, including Amazon, Walmart, and the DTCC. Others like Apple, X, Google, and Airbnb are reportedly considering how to integrate stablecoin-based payments into their platforms.

The appeal is obvious. Stablecoins settle instantly. They operate on weekends. They reduce frictions in remittances, merchant payments, and B2B flows. For large companies, they offer programmable financial infrastructure without needing to reinvent the banking system.

And perhaps most importantly, they are overwhelmingly denominated in U.S. dollars.

Roughly 97% of the global stablecoin market is dollar-based. Each new user is effectively opting into a dollar-native financial system, even if their local currency is something else entirely.

The Dollar Becomes a Protocol

In the past, dollar dominance was enforced through treaties, trade, and trust. A global reserve currency, yes. A global reserve asset, yes. But also a political instrument, backed by the U.S. banking system, SWIFT, and the Treasury market.

But something subtler is happening now.

The dollar is becoming a technology.

If we define a technology as a scalable system that extends human capability, then stablecoins are doing just that for the dollar. They’re making it programmable, composable, and interoperable — embedding it into APIs, wallets, fintech apps, and smart contracts.

In this sense, the dollar is no longer just the dollar. It’s software.

That’s what makes the “de-dollarisation” discourse — complete with BRICS currency speculation and headlines about the dollar’s supposed decline — feel so untethered (pun intended) from reality. You could argue the opposite: with the rise of stablecoins, the dollar hasn’t merely retained its reserve role — it’s expanded it. It has become a reserve protocol, powering a new financial layer that’s harder to sanction, easier to build on, and far more difficult to recreate overnight. A financial layer that is user-based, not confidence-based.

Traditional reserve assets rely on trust between governments. Stablecoins bypass that, going straight to the end user. Citizens in countries actively trying to opt out of the dollar system often end up pulling the dollar in through the back door. Dollar exposure is now accruing from the bottom up, not the top down. Citizens, not states, are pulling the dollar deeper into the global economy.

Of course, critics will argue: look at the DXY. The dollar is losing its strength and appeal.

True — the index has softened in 2025. But zoom out. The dollar has merely reverted toward its long-term average after an extended period of strength. No secular collapse. Just mean reversion.

Others will say: look at the flows: we’ve seen a pullback from U.S. assets.

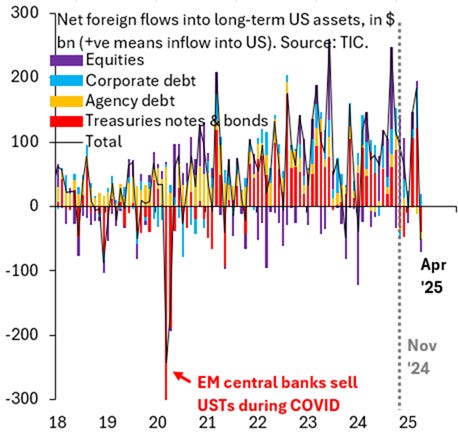

Also true. We have seen some exodus. But as Robin J. Brooks noted in his Substack last week, the narrative of the scale of global flight from the dollar doesn’t match the data. April’s tariff-driven volatility didn’t trigger shock levels of capital flight. Long-term outflows out of U.S. assets weren’t even close to where they were during COVID, for example.

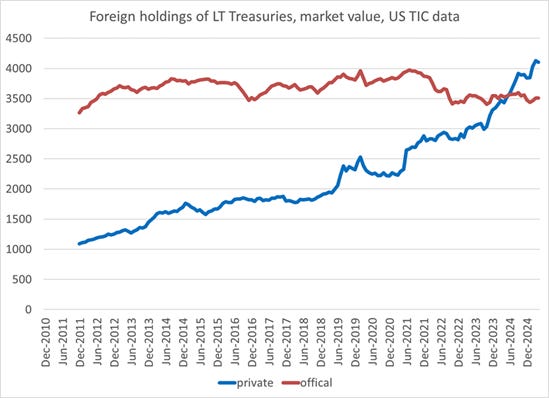

Finally, some will point to the declining appetite for Treasuries. And yes, foreign demand for long-term Treasuries has cooled, forcing the Treasury to learn more on short-term issuance. But even if long-term Treasuries lose appeal as a foreign reserve, the dollar might not.

One reason: dollar use is systemic. The eurodollar system, repo markets, and global shadow banking channels all run on dollar collateral and liquidity. And as I’ve argued before, liquidity is the game.

And stablecoins are digital eurodollars for the internet age.

Second reason: stablecoin adoption is proving self-reinforcing. As usage grows, so does demand for short-term Treasuries from stablecoin issuers. Circle and Tether now hold more than $250 billion combined in short-dated Treasuries, putting them just outside the top 10 foreign holders. This is an excellent chart from Brad Setser published June 18th showcasing this shifting replacement dynamic.

So in a world fragmenting politically and economically, the dollar, in my view, appears to be quietly becoming more entrenched. Not through diplomacy, but through distribution. It doesn’t need to be a symbol of empire. It can just be an open-source financial operating system.

Stable Coins: the future? Part 2

I'm sure all this talk of stablecoins sends most official, authorised central bankers into hives. They already have a difficult enough time managing existing liquidity flows. Superimpose stable coins over it and you have a wildly decentralised system which is increasingly unmanageable – and volatile. Cross Border Capital’s eminent monetary expert , Michael Howel,l has a great take on the consequences in his letter, mapping out a fundamental regime change underway:

The post-GENIUS Act World effectively creates a parallel monetary system where stable coins act as ‘shadow money’, funding government deficits while reducing the Fed’s direct role. These arrangements hark back to the origins of the Bank of England (1694) to finance the expanding British State (explicitly William III’s war against Louis XIV of France) and also resemble Modern Monetary Theory (MMT), where the Treasury (via stable coins) gains more direct funding power, potentially enabling the Federal government to run larger deficits without traditional Fed intermediation through QE or via its support of high street banks.

By implication, the current QT regime could quickly end, replaced with a return to more active open market operations by the Fed in the Treasury market. This would potentially give US policy makers greater control over the term structure of rates. It would make sense if this also coincided with the removal of the mistaken ‘Forward Guidance’ policies and so returned markets to a more cautious, less speculate ‘Volcker-like’ World where the Fed could once again use shock tactics to discipline investors. Runaway term premia might even slip back, in this case, and help restrain yields.

Watching Fed Liquidity alone will become even less reliable guide to Global Liquidity conditions. Treasury bill issuance, repo market strains, the growth of bank balance sheets and stable coin issuance become vital future dimensions to monitor. ‘Treasury QE’, namely debt management, should surpass Fed Liquidity in importance.

Fed Liquidity itself would likely fall back near-term and arguably become less cyclical, at least outside of crises, but it could still see long term growth. Potentially, short-term interest rates would see greater volatility, but overall they will be constrained by the need to keep down the government interest bill. Nonetheless, the high pace of monetary inflation looks set to continue and could even accelerate as the Federal deficit expands further in size. In other words, Global Liquidity will keep rising. If the US continues to spend like a Latin American country, it must continue to fund itself like one! Kicking the can down the road has worked for decades. The pace looks set to quicken. As Lyn Alden keeps reminding us, ‘nothing stops this train’.

What are the asset allocation implications? First, the interest rate term structure will be technically suppressed by careful debt management and a more active Fed. Rate volatility will rise and the MOVE index of bond volatility could stick in a 100-120 range rather than the ‘normal’ 70-90. This would be consistent with a VIX index of over 20.

Second, stocks may deliver a decent performance given on-going monetary inflation, but note that rising duration hedging demands will likely cause long-term funds to shift towards bonds. Evidence the UK and Japan where stocks have performed poorly for these same ‘demographic’ reasons.

Third, with the yield curve likely ‘controlled’ jointly by the Fed and Treasury, the building tensions may be released through a weaker US dollar. This is unlikely to mean a sudden collapse. Recall how Rome took centuries to fall. The dollar may still outperform rival paper monies in relative terms if the US inflates less aggressively than others. Early adoption of stable coins could even bolster the dollar through ‘first-mover advantage’.

Yet, in absolute terms traditional monetary inflation hedges should still excel. These are headed by gold and Bitcoin, but include other precious metals, prime residential real estate and large-cap stocks. Bitcoin and other crypto may also get a further lift from the legitimization and proliferation of stable coins, their fin-tech cousins.”

More HERE

Great article, as ever, thanks. On geothermal heat, I agree that electricity production is the most exciting in its potential, but it's so hard. I'm actually more of a believer in communal heat storage and am invested in https://www.theheatvaultcompany.com/. This is a British-based company but has been doing most of its work in Sweden, where communal heating schemes are much more the norm. The technology really does look like it works and is affordable. Sweden is not showing up on your map for some reason!