Monday Macro: Is it AI or liquidity pushing the markets forward, critical materials look becalmed, and equity investing in a period of high inflation

A shorter big picture note this week. I’m still bearish overall though getting less so. That said I think its time to tamp down the buying as we head into late spring and summer

Programming note: Next week (w/c 29th May) I’ll be putting out only a short Monday macro, and a Friday links with no investment ideas. Then, the week after (w/c June 5th), there will be no letters as I will be in sunny Croatia, exploring the sights of Split.

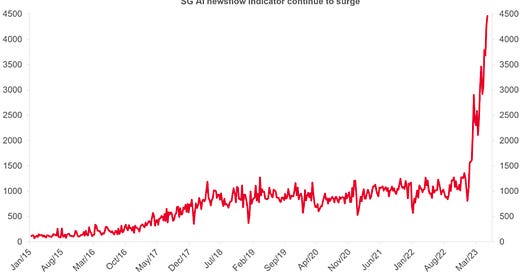

I wanted to start with what I think is an astonishing observation, from the quant equities team a…

Keep reading with a 7-day free trial

Subscribe to David Stevenson's Adventurous Investor Newsletter to keep reading this post and get 7 days of free access to the full post archives.