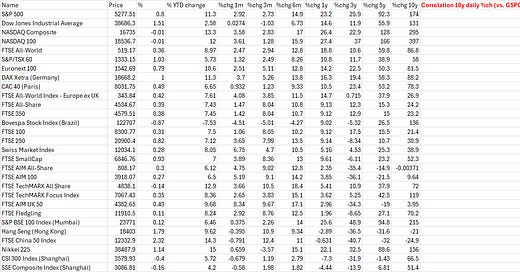

Monday Macro: May surprises to the upside again for equity investors, musings on how high (and low) US equities could go and why correlations matter

The S&P could push past 6000 if the bulls are right but a bearish take could see it fall back to above 4000. That said, global liquidity measures improve – a tailwind. But isn't it all about Nvidia?

There’s an old US (and UK) stock market adage: "Sell in May and go away." The period from May to November is historically the weakest for the market, although that is a simplified way of looking at market seasonality. However, analysts and investors have long argued that the saying oversimplifies the phenomenon. Liberum’s excellent strategist Joachim Kl…

Keep reading with a 7-day free trial

Subscribe to David Stevenson's Adventurous Investor Newsletter to keep reading this post and get 7 days of free access to the full post archives.