The Adventurous Investor in Conversation returns with another episode in which I catch up with Liberum’s alternative funds analyst Shonil Chande to discuss his recent study looking into buybacks and investment trusts. SEE LINK directly above to play the 25 min conversation.

Macro Matters: earnings continue to surprise to the upside

I wanted to start with this chart below (from the Daily Shot). It shows the sheer quantum of interest rate rises in a historical context. It's hard not to look at this and think a) my god that’s steep and b) surely it’ll peak very soon and then come down rapidly. This is probably why equities have had a decent few months although it’s also true that global equity markets are currently struggling to find direction. The slight fly in the ointment with this Panglossian way of looking at markets is that in no other era were interest rates so low, for so long. So the exponential increase is a mathematical necessity and tells us nothing about what might happen next.

Chart 1

Anyway, who knows what will happen to macro rates (inflation and interest)? What we can sensibly comment on is what’s happening to corporate earnings, especially in the trend-setting US market. And on this score, the news is surprisingly good. Here are analysts from Deutsche Bank in the US

“Earnings growth remains weak on a yoy basis but rising sequentially. Earnings growth on a YoY basis rose in most regions from Q4 to Q1 but remained modestly negative in the US in the low single digits, and negative in EM in the low double digits. In Europe, it has slowed to a near stall. In the US, as we highlighted last week, the level of earnings, adjusted for seasonality, rebounded strongly from Q4 to Q1 (+5.4% QoQ), recouping more than half the decline since the Q2 2022 peak. In Europe, earnings on a seasonally adjusted basis stayed flat in Q1, but this largely reflects the impact of Energy earnings falling on the back of lower oil prices. Excluding Energy, the level of earnings in Europe rose for the second quarter in a row but remained in the range it has been in for a year. European earnings continue to benefit from growth in the Financials.

Have downgrades ended? Consensus estimates for forward quarters continued to be cut through the earnings season but at a modest pace compared to the historical norm and especially mild compared to the large cuts in each of the last 3 quarters. In fact, 2023 estimates in the US and Europe have ticked slightly higher as the Q1 beats have more than offset cuts to the forward quarters. The consensus for 2023 growth remains near zero for the US and is slightly negative for Europe. On the other hand, in Japan and EM where consensus growth expectations are much higher (6%-9%), estimates have continued to fall. Forward estimates for China have fallen again after a short-lived upgrade.

Chart 2

Analysts at SocGen have also produced a handy ten-point summary about what we’ve learned from the current US earnings season – the bottom line is that its largely good news:

1. 6/10 US equities have been reported so far.

2. Strongest beats in six-quarters: We are seeing the strongest EPS beats in six-quarters with 82% of firms beating EPS (on lowered estimates).

3. 2023 expectations near 0: the strong season has put a pause on the downgrade cycle for the 2023 EPS expectations near 0% growth. 2023 EPS was downgraded by 8% over the past six months.

4. Alpha generation: stock that beat were up +0.7% vs Misses -2% on L/S basis. But no strong outperformance on those that beat.

5. In Styles: Growth is at the top with 78% EPS beats while Value is at the bottom with 53% beats.

6. In Sectors: Staples (95% of firms beat EPS) is the strongest in number of beats; followed by Materials (93%) and Communication services (92%). At the bottom are Financials which saw 60% of firms beating EPS and Utilities (70%).

7. EPS momentum: Past 4 weeks have seen the most positive change on 12m Fwd EPS for Consumers (Disc and Staples), Industrials, and Tech; While negative for Energy and Financials.

8. Profit Margins: The mean reversion on profit margins continues and the margins are now back to trend levels. Compared with history, margins stay well above average levels.

9. Artificial Intelligence boom: From our newsflow indicators, AI has continued to see an exponential rise during the reporting season (see Trading AI-hype).

Chart

10. Long story short: Strong season with EPS beats is a confirmation that inflation-driven slowdowns do not create a major EPS shock. We expect EPS growth of nearly 0% this year with three-quarters of negative growth. S&P 500 in the 3500-4200 range, renewed bull market only after a recession in 2024. Growth over Value, Defensive Growth over Cyclical Growth, Staples over Financials, Energy and Industrial over Consumer cyclicals are high conviction allocations.

As for major listed corporates in Europe, the numbers also seem to be surprising on the upside.

Here’s the highly regarded Graham Secker from the European equities team at Morgan Stanley in London on what seems like another surprisingly good set of European corporate earnings:

On track for a record quarter. 62% through earnings season, 1Q numbers are currently posting their biggest beat in over 15 years. Nevertheless, MSCI Europe is down ~2% since the beginning of the season, further reinforcing our view that this strong outcome was already priced in by the market.

41% sales beat, moderating through the season. A net 41% of companies have beaten consensus expectations at the top line now, an outcome that is still above the previous quarter (25%) but below the first three quarters of 2022 (average 59%). Weighted revenues are 2.6% above expectations at the index level, with the median stock sales numbers beating expectations by 2.1%.

Record 42% EPS beat. A net 42% of companies have beaten consensus EPS expectations so far this quarter which, if maintained through the end of the earnings season would be the biggest beat since we started compiling data in 2007. Weighted earnings are currently 13.4% above expectations at the index level, with the median stock coming in 9.5% ahead of consensus numbers.

Those of us with a more bearish disposition have to face reality – we expected a fairly sharp decline in corporate earnings which would then push down share prices. Earnings ARE declining but not by as much as we expected – yet. Maybe if we do slip into a recession – and that’s only a probability rather than certainty – then those earnings downgrades will roll on in!

More on De-dollarization

One of the central debates of our time is the focus on US assets amongst financial investors. Put simply, we’re all a little bit too US-centric although that’s only a function of ‘following the money’ i.e. US equity markets dominate developed world equities as do US bonds and dollar trade flows.

Thus the endless debate about the slow demise of the dollar is in fact just a proxy for a much deeper concern with this US-centric worldview. If the dollar starts to fall from its hegemonic position, then maybe US equities and US bonds might follow. And of course, there’s a geopolitical element to this – if the US is relegated from a dominant hegemon to a muti-polar world, then there are myriad political and economic consequences.

My guess is that multi-polarity is real and that the US dollar is not as hegemonic as it was, but it’s also clear that the dollar is still pretty damned dominant on most common sense measures.

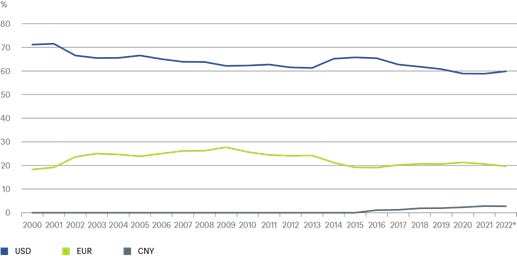

For instance take the dollar’s role as a global reserve currency, where the dollar‘s share has declined once adjusted for price changes. But as analysts at DWS point out once we look at this in nominal terms, the decline doesn’t look very significant at all! The chart below from DWS shows the currency reserves of central banks worldwide, as far as they are reported and can be assigned to a currency.

“It's a picture of stability, but depending on which starting year is used, it can certainly be used to tell stories about the dollar's decline. Questions such as "Will there be a dollar crisis?" and "What would be the macroeconomic scenario of a sudden collapse of the greenback value?" have not only been the subject of market chatter in recent decades but also of profound economic debates]. "We expect steady de-dollarization to continue in the coming years, reflecting in part the growth and increasing financial literacy in the rest of the world," argues Dr. Xueming Song, currency strategist at DWS.”

Graphic: A reassuringly boring picture of the dollar holdings of the world's central banks

* Data up to Q3 2022

Nevertheless, one doesn’t have to buy into the whole “End of dollar hegemony” argument to accept that we moving into a more multi-polar world. I think, in a funny old way, the US would quite like that as the pressure on it to be the global policeman is unmanageable. Ditto for economic power – if I were the US Federal Reserve I’d be a bit miffed at constantly having to bail out our friends and frenemies.

If we accept this change then we also need to accept that the global commercial rules set down after Bretton Woods are changing. National security considerations are becoming more and more relevant. US-based analysts for investment bank Morgan Stanley reckon that these slow changes open up opportunities for investors:

• “The ‘great productivity race’ will benefit some sectors but challenge others: Efforts in the US to re-, friend-, and near-shore critical industries have strong political support. But these initiatives narrow the geographical options for US multinationals, making cheap labor – particularly for skilled manufacturing – harder to find and exacerbating an underlying US economic challenge. Similar historical conditions have pressed companies to focus on improving productivity through the development, diffusion, and integration of new technologies. We expect US companies to invest in infrastructure and new technologies, AI, in particular, to boost productivity. Companies that rely on labor and lack substantial financial resources will likely be challenged by this dynamic.

• “Security as an investment theme: Global policymakers continue to pursue initiatives (non-tariff barriers, export restrictions, tax credit incentives, etc.) aimed at protecting advantages in key technologies and diversifying access to key materials and products. This spend on de-risking to achieve ‘security’ could reach $1.5 trillion across the US and EU. Our analysts see 80 critical infrastructure stocks that should benefit from this transition.

• “Change may create regional beneficiaries, like Mexico: Countries with sizeable labor pools, competitive wages, and proximity to end markets stand to attract investment as multinationals reorganize their value chains to accommodate geopolitical constraints. Our strategy and economics colleagues argue that Mexico and India are key potential beneficiaries.

Defaults rise and peak Gig economy

I’ll finish the Macro roundup with two very interesting charts which I think tell us that the old economic order is changing under our feet and something new is emerging – quite what that new thing looks like is anyone’s guess.

The first chart is via Adam Tooze’s excellent substack and shows that the volume of US corporate debt trading at distressed levels — a risk premium of at least 10 percentage points over the benchmark for bonds, or a price of fewer than 80 cents on the dollar for loans — has surged some 28% since last month’s banking crisis to around $300 billion, according to data compiled by Bloomberg. That figure stood at up from about $74 billion a year ago. This is probably a grim warning to all those tempted to buy into private credit and debt funds - defaults are rising fast.

Source: Bloomberg

The second chart focuses on the gig economy, which looks like it's peaked. Clearly, many of us don’t really like the uncertainty that goes with the more flexible, gig economy.

Source: BofA Global Research

Investment Ideas: Buybacks, Microsoft, and buying into gold ETCs

Do buybacks work for investment trusts?

At the top of this note from today, you’ll see a link to my latest Adventurous Investor in Conversation with Shonil Chande, alternative funds analyst with Liberum.

Our topic?

Do share buybacks work for investment trusts and their investors? Shonil has been digging around in the data for alternative funds and as you’ll hear in our discussion he concludes that buybacks can be effective but only in certain circumstances. I also talk about buybacks in my column for Citywire this week.

To listen click the link at the top of this newsletter.

Buying into gold ETCs

Investors have always been attracted to gold in uncertain, turbulent markets. Look at classic portfolio combinations such as the Permanent Portfolio, which are designed to protect against the ‘unexpected’, and you’ll see that gold is one of the four equally weighted components. If nothing else, if things go really bad and we all head for the hills – or to the bunkers – then gold is also portable and instantly recognizable. Yet gold is also viewed by most professionals as the financial equivalent of a barbarous relic and something which an alien from Mars would struggle to understand as a safe haven. More quantitative finance-driven types tend to be a little more understanding of the shiny stuff, pointing out that in certain economic regimes such as the unsettled 1970s, gold did provide diversified returns in a more inflationary environment. But they also quickly remind us that gold’s relationship with macroeconomic ‘regimes’ is highly contingent i.e. it depends on lots of conflicting processes and influences. In this vein, the problem with gold is that its alleged hedging properties – especially against some types of inflation – come with lots of caveats and complications. Yes, it is a good inflation hedge especially against hyperinflation but not necessarily with all forms of stagflation. Gold is also heavily impacted by the absolute level, and direction of, interest rates. And then there’s the dollar which exerts its own gravitational force.

Put it all together and you end up with an asset class that does have value in volatile times but is ‘complicated’, as my kids would say i.e. it works sometimes but not always. That said, it’s clear that gold has retained its value in recent years and hasn’t fallen away as it has after previous highs. And according to Gerry Celeya, chief strategist at Tricio and one of the best quant-driven technical analysts out there, gold is looking more interesting from a short-term point of view. He suggests watching the “ $2,072/oz. area all-time high to see if this holds off gold bugs, with support layered at $1,980/oz., $1,930/oz. and then $1,800/oz. ahead of the $1,600/oz. zone. A sustained break above $2,072/oz. would leave risk at $2,200/oz. and higher open, yikes!”.

I personally have no set view of what will happen to gold next month, next year, or even in the next decade. I don’t regard it as a barbarous relic and would note that plenty of central banks buy the shiny stuff as an insurance policy – if it’s good for pointy-head central bankers, it must have some utility. Equally, though I am aware that gold doesn’t produce any cashflows, and apart from limited use in jewelry and to a lesser degree industrial processes, it doesn’t have much functional utility except as a sum of all our fears. In simple terms then, gold is useful some of the time but pointless most of the time. Whether it will be useful in the next six months, I leave it to your judgment.

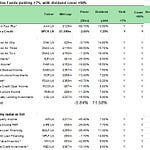

But if you are attracted to gold, I would suggest checking the table below which lists the various gold-based trackers – these are usually exchange-traded commodities and are usually, though not always, physically backed. This means that for every £1 you invest – or more typically $1 – you get £1 of physical, allocated gold in a vault somewhere (less the charge for expenses of running the ETC). The location of that vault does have some relevance – most of the time those vaults are in the UK or the US but some investors like the option of owning physical gold in a jurisdiction such as Switzerland which is highly unlikely ever to try and confiscate your gold – as the US did in the 1930s.

The cynic might suggest ignoring this concern with jurisdiction and focusing only on the cheapest tracker but there are some other considerations worth bearing in mind. First, do you want to invest in a dollar-denominated tracker – the most common – or a sterling-priced one? An alternative might be to invest in a tracker which hedges out the sterling risk – a sensible strategy when sterling is weak, less so currently. Some investors also like to think they are not investing in gold whose provenance on ESG grounds hasn’t been verified – thus responsibly sourced gold from say the Royal Mint here in the UK might seem attractive (HANetf offers a Royal Mint ETC). Investors might also find themselves attracted to the largest ETC by market cap (from iShares) – thus almost certainly guaranteeing the smallest bid-offer spread and most liquid trading environment. Last but by no means least, gold equities might also be attractive – they have very different return characteristics though they tend to be more volatile in terms of pricing. The table below lists your main gold ETC options for UK-based investors.

More on Microsoft: investors like what they see

Regulars will know that I’m a reasonably big fan of Microsoft, one of the most over-owned stocks on the planet. I think its economic moat is huge and getting bigger all the time, especially as it builds up its AI business and its cloud business. Here’s an interesting take on the software giant from Manchester and London’s fund manager Mark Sheppard:

“Following results, Morgan Stanley released an excellent note on their forecasts for Cloud Computing growth up to 2032. The graph below is a salient summary of the Investment Thesis for MNL LN:

Cloud Computing grows at 17% CAGR, Valuations travel in tandem, and +AI drives similar Semis growth, which in turn drives EDA growth. The story really is as simple as that. It is up to Investors to asses it's validity and likelihood. The big questions for MSFT are:

· Can they continue their relentless push of AI initiatives (Copilots in advertising, security, etc.) that are driving market share in Enterprise; and

· How much share can Azure take off AWS (which further erodes the AMZN bull case)?

· How many more quarters does Cloud Optimisation continue for and how much more deceleration is to come?

· How does the regulation of AI develop?

“It amazes us that UBS seems to be calling the end of Cloud Computing growth when only ~20% of IT workloads have shifted to the Cloud. UBS is either very smart or very dumb, time will tell.

The other very positive development we are seeing is consolidation in the cyber security market. As Keith Weiss of Morgan Stanley put it:“We are increasingly perplexed as to what exactly each of the numerous log management, cyber security companies actually does that none of its competitors can do equally as well. We were at TMT this year when after dragging Richard to two log management companies in a row who said almost identically the same thing, Mark then assured him that the next meeting Mark suggested would be a fresh break only for the third company to spout rote what the previous two had just said before! There was much eye-rolling! Anyway, this all begs the next question, can AI do it better and cheaper? We think the resounding answer to that question is Yes it can!”