Last week I caught up with Charlie Morris, who many of you will know has been an influential voice amongst active private investors. Here’s his biog from the excellent Multi Asset Investor website:

Charlie Morris is the Editor of The Multi-Asset Investor. Prior to this he was the Editor of the Fleet Street Letter, a market newsletter for private investors published by Southbank Investment Research with a wide readership. He is also the Chairman and Chief Investment Officer of ByteTree, which he founded in 2014 as a platform to deliver independent, robust and thought-provoking market analysis.

Charlie has 25 years of fund management experience and is a pioneer of multi-asset investing. At HSBC Global Asset Management, he launched the Absolute Return Service in 2002, which grew to over $3 billion.

Charlie recently set up Bytetree Asset Management which is probably best known for its crypto exchange-traded product - working alongside 21Shares.

I thoroughly recommend having a browse around the Bytetree website - https://bytetree.com/ - if only to access its tools.

Here’s a tip - go to the top right-hand side of the page, look for the Terminal tab and click. You’ll then be taken to a free to access data terminal which features lots of technical info on crypto. Now look to the left hand side bar and you will see ETFs, and under that heading Scores. Click on that and you will come to a dashboard which shows you the best ETFs using Bytetree’s scoring system, which borrows heavily from technical analysis.

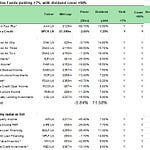

In the graphic below I’ve screen captured the top ETFs from Tuesday the 24th of January. According to the Bytetree system, Industrials ETFs are looking strong along with a high dividend, low vol ETF tracking US stocks.

Anyway, it’s well worth listening to our 30 minute + chat where we speed Charlie’s views on the investment universe :

- We discuss why Charlie is bullish on US equities

- Gold looks to be a steady bet

- Why crypto is here to stay

- And why Japanese equities - one of my favorites - are not a sure fire win

At the bottom of this article, I have also included an automated transcript of the interview - it’s not edited, so please treat it with some caution. But you’ll get the ‘gist’ of the conversation. Go to the bottom of the email.

Music Funds - a useful reference point

One of my strongest buys for 2023 is the Hipgnosis Songs Fund. As I have said more than a few times, I have had some reservations about the fund in the past, not least that it is in a specialist market with a paucity of active participants, which in turn makes establishing a ‘market’ price for its private assets tricky in the extreme. At some point though those concerns are factored into the price and at 86p a share - on a 41% discount - I think there is now a sufficient margin of safety. I have a 100p target for the shares.

But those concerns I mentioned above have not entirely gone away and thus I’m always interested in any market benchmarking of rates and yields on music collections. This is where the excellent Matt Hose, funds analyst for Jefferies comes in. Earlier this week he reported on a transaction that does give us some hint of what a ‘market rate’ might be. Over to Matt:

“One of the difficulties in assessing the portfolio valuations of music royalty funds SONG and RHM is that transaction comps are hard to come by. Sale prices for high-profile music catalogues are often made public, but the level of underlying income is not. As a result, transaction multiples are rarely visible. However, one notable exception appears to be Dr. Dre's catalogue, with Variety reporting that the rapper and record producer is selling 'a collection of music income streams and other assets' in a $200m-$250m deal. The assets are reported to generate nearly $10m annually, therefore implying a 20x-25x multiple. If correct, this would provide a useful comp for the pricing of top-tier catalogues. While it is only a single data point, it appears at odds with the view that catalogue pricing is softening, so in turn, would help validate the funds' valuations.”

China

By the time you read this, we’ll be at the end of the Year of the Tiger and into the Year of the Rabbit. According to Michael Pettis, an economist based in Beijing, the “Year of the Tiger is supposed to be a turbulent but successful one, and while it was certainly the former, I think it may not have been the latter for a lot of people. The Year of the Rabbit is supposed to be financially complicated and a good time to cut losses. Make of that what you will.”

I’ve had quite a few investors write to me asking me how they can invest in Chinese equities through an accessible listed fund. I have to say that I am deeply, deeply, deeply (enough deeply’s ed) cynical about Chinese equities and corporate governance. I can entirely see why investors might want to look past these concerns but for me, they are real and ever-present - you are in effect investing your money into the Chinese Communist Party and its tentacles in business. I genuinely believe the CCPs’ Marxist rhetoric - its not lying about its dogmatic communism. That should be warning enough for any investor.

The excellent American based China hand Dexter Roberts I think nicely sums up this view as follows:

“But if you listen to the leadership, take their words at face value, including their clearly stated goals for where they want to take China and the party’s role in that, the unavoidable conclusion is that the loosening of control now will be temporary, and the longer term direction will be further tightening. There is a curse that comes with watching China over many years, which I have been doing since the 1980s (it’s similar to the occupational hazard that comes with teaching modern Chinese history and politics, as I do at the University of Montana.) You can’t help but start to see some of the same attitudes, same beliefs, same policy choices mirrored across generations of Chinese leaders. And one constant has been the primacy of the party over all, a party that must regularly assert its dominance, even when doing so comes with real costs.”

But I also accept that on a speculative basis, Chinese equities might be cheap. By some reckonings, Chinese onshore equities are now cheaper than they were in 2016. And it doesn’t take a genius to work out what might happen this year as zero Covid bites the dust.

The first quarter will be genuinely horrible but then there will be an almighty roar as China gets back to business. This will result in an inflationary pulse globally and then a massive surge of exports. No doubt the CCP will be keen for 2023 and 2024 to be years that everyone enjoys - pushing up central bank liquidity to help push the system along.

Plenty of respected observers think the same - according to Pettis, “I actually expect this year's reported GDP growth to be higher than the target, perhaps closer to 6 percent than to 5 percent and, more importantly, for the "high quality" growth component to be substantial, as we get a partial revival of last year's terrible consumption. This will be similar to – although not nearly as extreme – as what we saw in 2020.” That sounds fairly positive to me!

Here’s Dexter Roberts again, summing up the market consensus - and issuing the necessary caution!

While growth for all of 2022 came in at just 3 percent, well below Beijing’s earlier target of 5.5 percent, the last quarter of the year registered a rise of 2.9 percent, above analyst forecasts of 1.6 percent.

“The outlook for GDP growth in 2023 has improved compared to our prior outlook,” says ING Groep NV’s Iris Pang, who is now predicting a rise of 5 percent in 2023. “That is not to ignore the fact that China still faces considerable headwinds, including external demand, with recessions likely in the US and Europe this year.”

“China’s fourth-quarter GDP should be viewed with both concern and a degree of relief. The overshoot relative to expectations will assuage worries about a crash,” say Bloomberg economists Chang Shu and Eric Zhu. “High-frequency indicators suggest that the economy may have have bottomed. We see a solid rebound taking hold in 2Q23.”

But some are expressing skepticism about the veracity of the numbers, citing discrepancies. For example, while most industries fell in December, the figures showed industrial production overall rose. Car production dropped by 16.7 percent, but still sales grew by 4.6 percent. And while cement output did shrink, down 10.8 percent, that number was dwarfed by a 28.3 percent drop in housing sales.

So 2023 should be a good year for Chinese equities and we’ve already seen a surge - which might last longer and go much higher. Where does leave investors?

What are your choices?

This week I’ve tried to provide a guide to what you should be looking for ina Chinese equities fund.

The first question you need to ask is whether you will use an actively managed fund - preferably an investment trust - or a passive, index-tracking fund.

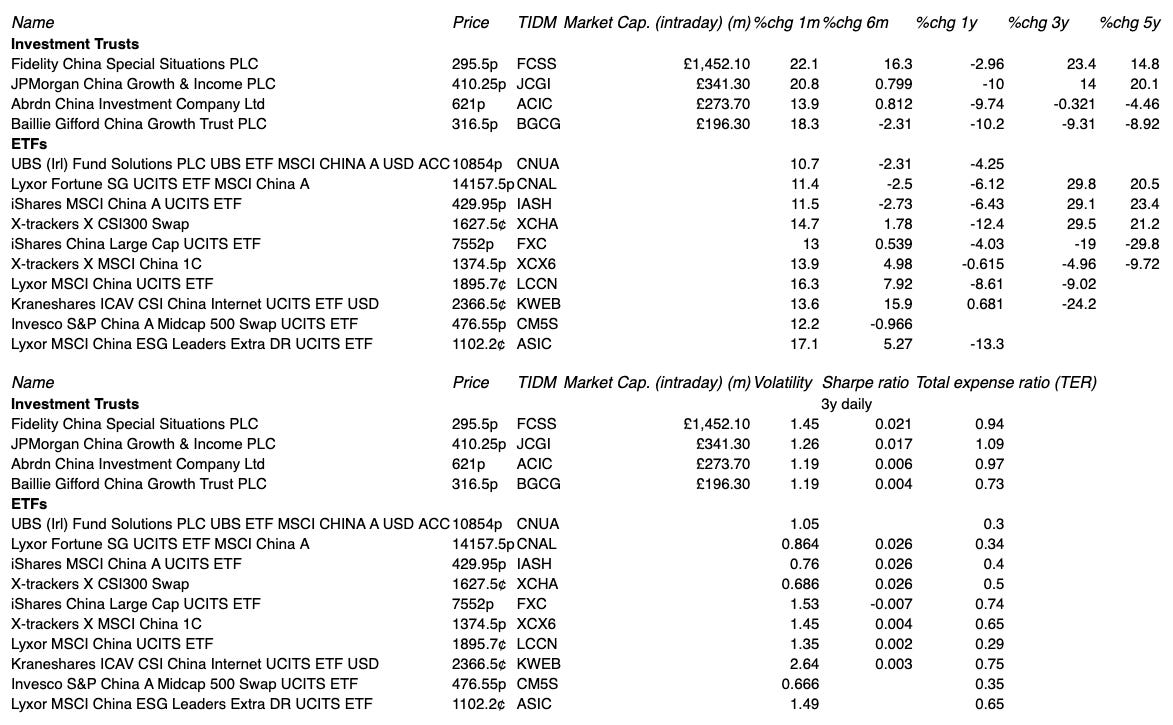

Cue our first table below. This shows the top four funds (active and passive) over various time frames in terms of fund performance. What’s obvious to me is that active funds do not consistently outperform all passive funds - quite the contrary .

In fact I would say it’s a toss-up between active and passive but if I had to pick an active fund I would probably pick Fidelity and its China Special Sits fund. One point to note - over the last month, actively managed investment trusts have trounced ETFs.

Your next decision is which index to track - assuming you have gone down the ETF route. In the next table below I’ve mapped out the main indices tracking Chinese equities. I have no particular preferences - it entirely depends on what you think works for you. If pushed I suppose I might say that I prefer the MSCI China A shares index.

The table below maps out the main passive and active funds available in the China equities space. On the ETF front I have deliberately excluded funds with an AuM of less than £100m.

My overall observations would be as follows:

- If you are looking for the cheapest ETF then I would go for ticker CNUA - the UBS (Irl) Fund Solutions PLC UBS ETF MSCI CHINA A USD ACC

- If you are after the largest ETF by AuM then I would go for iShares MSCI China A UCITS ETF, ticker IASH

- In terms of performance I rate the X-trackers X CSI300 Swap highly, ticker XCHA. Its TER is a lowly 0.5% but it is a swap-based product which puts some folks off !

- In investment trust land the Fidelity China Special Sits fund is the biggest and in my view the best.

Charlie Morris's interview as a transcript

Please note this is an automated transcript and has been very lightly edited but is machine-generated!!!

David Stevenson 00:00:00 Hello and welcome to another installment of the Adventurous Investor in conversation. This time we're talking to Charlie Morris . Um, he used to be at HSBC running an absolute returns fund, um, and has been running various funds in the absolute return space for many years and has also been building up quite amid reputation in the whole crypto space. Um, he's even got an e TP in exchange trader product with 21 shares, which is a combination of both, uh, Bitcoin and Gold. But, um, in this episode I talked to Charlie more about his overall asset allocation views and where he thinks the key markets are going. So absolutely worth listening to. Also worth checking out his website, which is, uh, over a bite tree. And that's B y t e Tree, bike Tree. Um, they have a brilliant, um, newsletter called the Multi-Asset Investor. So join me as we talk about all the asset classes, including crypto and gold and US equities with Charlie Morris , Charlie, um, Charlie Morris on, Byre, welcome. And um, I thought we kick, kick straight off with the, I suppose the 64 trillion question, which is overall for kind of risk assets, things like equities, and by default I suppose we mean US equities cuz they're the largest bit of the most liquid market on earth. You bearish or bullish at the moment?

Charlie Morris 00:01:30 Um, David, I'm bullish and Oh,

David Stevenson 00:01:32 Right, right. Why? I mean, cuz I, a lot of people are bearish at the moment, aren't they? They're all people, boring, cynical types like me are sort of going, oh my God, we're just about to have recession earnings, us corporate earnings about to get good kick in. So why are you bullish?

Charlie Morris 00:01:47 There's lots of reasons. I mean, I think to illustrate, um, that I'll start off by saying I've been a be two years. Yeah. And, um, and I've recently turned the corner and, and that's market evidence that gets me there more than anything else. Why was I bearish beforehand? Well, the main reason was the bond yields were going up very, very aggressively. Yep. And that's stabilized. Why have they stabilized? Well, lots of reasons, but the big one is probably inflation. Not 20%, but more like six and heading south. Yep. We've seen the energy prices in Europe down 80% since last August, 50% down in the last month. That's the, the, the, the North Sea, uh, gas price. So, you know, life's not near as bad as it was a few months ago when we had soaring bond yields, which caused the blow up of the UK Gils market.

Charlie Morris 00:02:35 All of these sorts of problems. Um, and, and so there's been some stability, uh, over there. Add to that the reopening of China, which confuses our recession. Cause you were gonna have, you know, western world slow down at the same time. Yep. And sudden you've got this countercyclical force kicking in. So not, not not simple, um, different things happening in different places as always. Um, but I think that the, the, the extreme bear argument has been given a kicking. Yeah. I'm not, I'm not a mega bull by any means, but I do think we've got a period of stability and right now that means prices going up. And what I'm saying actually is more that there's a rotation within markets rather than, um, a straightforward bull market. And that rotation is huge. And to illustrate that, you've got companies like Microsoft and Apple, if you add the value of those two companies together, you know, in recent times you find they've been worth more than the United Kingdom stock market, which is just beyond, beyond ridiculous. When our cashflow, you know, are combined profits of our companies are materially larger than those two companies. Despite, I'm not, I'm not saying they're not successful and great, this is a huge rotation outta, outta uh, uh, big tech into old economy. And that old economy is not just Britain, it's Britain, it's Europe, it's Japan, it's Asia, it's emerging markets.

David Stevenson 00:03:52 So is this the rest of the world argument? The r o w which is Yeah. So basically rotation not only outta growth into value, I'm saying that with kind of air, air apostrophes, um, but but rotation out of us into rest of world.

Charlie Morris 00:04:05 Absolutely. Right. And I, and I'd say the other point is the dollar, the dollar's hugely overvalued, um, on a purchasing power parity going back half a century. Yeah. And you're talking nearly 40% at one point last year. Um, it's on the way down. Doesn't matter what they do to interest rates, uh, the dollars overpriced. And um, you know, so you put those things together and you realize that the reasons to be really bearish a year ago are no longer, uh, valid. So yes, recessions, inverse deal curves, I see that. But are there, is there are some of those things gonna be tempered? Cause it's not as bad as we thought?

David Stevenson 00:04:39 Um, what about the other, the other big asset class bonds? Um, I mean, I suppose, uh, your, your view on anybody's view on bonds is I suppose has to be tempered to use your expression by what interest rates are gonna do. Um, none of us really know what's going on in the minor central bankers. And I'm not entirely sure central bankers know what's going on in the minds of central bankers. But, um, is your sense that the consensus, which is the interest rates will probably in the US peak at about five, a little bit above, bit bit below you at UK for maybe a little bit above, maybe a bit below, and that they'll stop rising and then possibly head down even if slowly at first. Do you think that consensus is right?

Charlie Morris 00:05:21 Well, no, not because I know what's gonna happen, but just because the consensus never been right.

David Stevenson 00:05:26 Yes, exactly.

Charlie Morris 00:05:28 <laugh>. Cause it's never, ever been right then why it's gonna be right this time. So I think that's the important point there. Um, I dunno, I really don't know about bonds. I'm really, I'm really quite cautious on duration because if you already said you got an inverted curve, and so there's a lot that could go go wrong with, with, um, with duration and at the short end. Yeah, there's a bit of excitement to be happen. Not much. I get that. Um, earnings may be coming under pressure, so therefore credits, you know, I I can see it's going up short term. But again, is it underpinned? Not really. Is it dirt, heat? Not really. The bit of the bond market I do like, um, um, is, is, um, inflation link bonds Yeah. In the United States. Yeah. And, and you know, I I I've been a bit of a fan of gold really since about 2018 and now I'm seeing go very overpriced against us tips. And of course, you know, you can lock in now one and a half, 82%, uh, real yield in in tips. And that's, that's a big number. You have to go back 3 0 8 to get that.

David Stevenson 00:06:28 Do, do you think ju just, just wanna just dwell on tips for a second in inflation, um, uh, only recently Duncan McKinneys over at Rougher has been making the argument that, um, that, and, and he's not the only one actually Albert Edwards SocGen has been making the same argument. The inflation, as you said, might come down because of all the base effects. You've already talked about declining energy, price, all that kind stuff. But they might ratchet back up again and we might be in a more stagflationary era, um, just on that narrow inflation point. What, because that, if that is the case and none of us know, cuz none of us have a crystal ball that works. Um, but if we are have moved to a more stagflation in your environment, there are profound consequences for lots of portfolios here, which is supposed to point rro making. What do you make of that narrow point? Do you think we're, we're we are, we might get a breather, but then it we are gonna see sustained inflation pulse through or, or, or, or, or just did not know. No, like most of us,

Charlie Morris 00:07:22 So I I've studied the 1970s like, like they have and what we saw in the seventies was, was inflation was volatile and all emerging markets that have had what is inflation, it's an inefficient economy. Yeah. No, inflation is a super inflation efficient economy. Sometimes it can be marked by capital flows, you know, like Switzerland, you don't really know if they're, they're, they're affectionate or not. But everyone throws money at them. Yeah. <laugh> all looks great. Um, but, you know, an affect economy like Japan long term has had lower, lower, lower inflation than other places. Uh, the UK is an island off the coast of a big continental, um, economic powerhouse. Our inflation's always been slightly higher than Europe cause they're a bigger trading block, of course. They're more efficient than we would be. And historically, Ireland always had higher inflation than we did because they were a small economy, uh, separated by sea.

Charlie Morris 00:08:09 So there, there is something in that and inflation, when you lose control of it basically tends to be volatile. Yeah. So it's already the level so much, it's the fact that it chops and changes and, you know, gmo, GMO being the big US value manager. Yep, yep. Um, they had, uh, this wonderful s and p valuation, uh, model that they trotted out once and it seemed to work, it probably stopped working off that paper, but, but, um, it was really good. And one of the inputs was the volatility of inflation. And so they said, so basically what, what the conclusion being that when inflation's volatile, you dunno what's gonna happen. Therefore you've gotta have a, a low evaluation on asset prices.

David Stevenson 00:08:46 Yeah. So do you think inflation's gonna be volatile?

Charlie Morris 00:08:49 Yes.

David Stevenson 00:08:50 Okay. I'll answer that question back to tips. Um, so, um, should we own tips versus gold? Now, does, does effective, are you saying that tips is a better bet than gold

Charlie Morris 00:08:59 On valuation argument? And that valuation, uh, relationship between tip tips and gold goes back quite a long time. The only reason you wouldn't, the only, the only reason why I'm, you know, why that would be completely wrong is because you believe something's changed in the gold market. You believe that, uh, that the US treasury treasuries have been weaponized following the invasion of Ukraine. The Russia had its reserves, uh, confiscated. That's not a very nice thing to happen. And, um, and sort of poor form in sort of battlefield, um, um, civilly if you like, compared to what we're used to. You know, you don't

David Stevenson 00:09:35 Don't need shit Central bank shiv anyway,

Charlie Morris 00:09:37 Central Bank, Shiv,

David Stevenson 00:09:40 <laugh>.

Charlie Morris 00:09:40 And, um, it's an important point. So if you are now, um, an economy or a country that, that doesn't quite agree with our values, then, then you would say, well, I'm not going to park my reserves in their bones anymore. I'd do something else. So maybe it's right that, that that gold goes to a prolonged premium. And we saw in q3, you know, 399 tons of gold bought by central banks. Yep. You know, the biggest buyers being Turkey is be Pakistan and, uh, a guitar. And then we, we started to see China admit to higher, uh, reserves as well. So we've got these big numbers coming through and you kind of think, okay, if all of them are gonna pile their reserves into gold at any price, then something's changed. They didn't have to, they don't have to obey the sort of natural forces of the tips model.

Charlie Morris 00:10:32 And the reason why the tips model work, by the way, is because golden long-term tips have the same objective. Yeah. Which is, you know, to protect you against the destruction of capital over time, uh, or the value of money over time. So, um, there's a, there's complete logic there. Um, but I, but I would think that tips are also going to to, you know, deliver what they're, deliver that contract provided you, not in any any of the state. So if you are, if you're on the, their side, tips are great. If you're not on their side, maybe you have to go for God.

David Stevenson 00:11:01 Okay. Um, just going, tips are obviously denominated in dollars. So that's the segue. You sort said that dollars are dollar, the dollar is overvalued. And I, I have to agree with you, uh, and I suspect actually even in the US Federal Reserve might agree with you as well. Um, but that's separate issue. Um, what's undervalue,

Charlie Morris 00:11:18 Um, on the currency side? Yep. The Japanese yen, by long way, the Swedish Croner as well, the pound was less so now, but you know, the pound whenever it's been undervalued, which has been sort of 92 er m um, and, and the other great time was off the credit crisis and, and, and Brexit. You get these sort of brief periods, uh, where it's undervalued and it tends to be an equity bear market because the pound tends to be, um, overvalued during bull markets because we're a financial center. Um, right now the Swedish pro seems to be dirt cheap. Uh, and the Japanese yen is the elephant in the room that everyone's talking about. Um, and that's, that's down to, as you, you know, David, it's the, you know, yield curve control. Yeah. You can't keep the 10 year bond yield, um, at levels of the markets doesn't want. And, and you know, you get an er m type moment when the market says no. And it, you know, the, the, the Japanese has got away with us for a long time. Very, it's a very simple reason that everyone else had low bond yields. Yeah. Now, you know, America, Europe, Britain,

David Stevenson 00:12:14 Charlie, I get that. But why hasn't it happened yet? Because, you know, um, you know, on, on u on uk, US government, even European government bonds, you can get pretty good yields Now, um, I I quite like sort of long duration US treasuries, they're paying decent yields. Why would you own Japanese, um, government securities unless you had to?

Charlie Morris 00:12:34 So no one does, I mean, it's, it's hilariously a sort of slightly illiquid market, but they're there. They're big, they're a big asset first. Um, and, and it's one of those things that, you know, some people will tell you that Japan's a most deadly country in the world, but you know, this is a left pocket right pocket situation. Yeah. You know, if you own a trillion in one pocket and you owe a trillion in the other pocket, you know, you, you you are, you are flat. And that's kind of where Japan is. Um, so they're not really, they're, they're an extremely wealthy nation. But I, but what what they can do is, you know, we we we've learned about printing money in recent years. It's a funny old thing. You just sort of ask a computer to do it for you and suddenly a few zeros pop up,

David Stevenson 00:13:10 That's the button. Yeah.

Charlie Morris 00:13:11 But there you go. And that's what they're doing. And they're buying all these bonds off themselves each week. Um, but I think the speculators have, have, have caught wind of this. But basically when the, when the yield goes up on long-term Japanese debt and that makes the end more attractive. And so the undervaluation reversed to mean, and, and we've seen this in previous sort of cycles like 2008 and so forth, you know, people like to borrow money in yen because the Japanese like to keep their currencies soft and their exporters and so forth. And when it's payback time, which is whenever there's a, a soft economy, uh, the yen goes through the roof. Yeah. So, um, so I think that the Yen's a very interesting trade right now as part of risk of, so things do go wrong than theen are,

David Stevenson 00:13:50 Would that extend to Japanese equities?

Charlie Morris 00:13:53 That's more confusing. So you don't wanna win the box, you do wanna win the currency. I think the Japanese equities are somewhere in the middle. Yeah. It's, it's probably the banks, um, ironically are probably in a better place than, um, than the exporters, for example, which are gonna suddenly, you know, find themselves less competitive. But I think that it, it, it's gonna be a mixed response. It was very clear once upon a time that, you know, that the yen went up and, and the Japanese stock market went down. But, but that's not really the point we wanna know is you take, take the Japanese stock market in pound sterling and the world index in we British and, and, and, and the world index in pound sterling, and which is better? Which one do you wanna word? And and that's the question, aren't Japanese equities better than the world or worse the world?

Charlie Morris 00:14:36 And they've been worse since 1990. Yeah, it's 20. We we're getting to the 23rd year of Japanese equity underperformance versus the world, sorry, 33rd year. That's a hell of a long time, David. Yeah. So at some point we're expecting that to turn. And some people would say that actually Japanese equities are, are undervalued and it's a real opportunity. Cause um, when they stop doing this funny money business then and it starts to go to sort of normal situation, they actually become really attractive. Um, I'm somewhat on the fence when it comes to Japanese equities, but I'm certainly happy to interview.

David Stevenson 00:15:10 Um, I just wanna sort of also just deal with the issue of what, what investors actually invested practically if you're a private investor. Uh, and on your Byre website before we, we, we started going online, we, we showed a quite interesting et TF tool, um, which, which looks at, uh, effectively a technical, correct me if I'm wrong, mainly technical analysis, but with some value kicking around as well. And you're looking at 20 day, 30 day, 200 day moving averages and you select the ETFs using that tool, which I hardly recommend people go and look at, and I'll put it in the program notes. Um, what's your tool at the moment suggested they should invest them in ETF land?

Charlie Morris 00:15:45 Yeah, well, so I write a, uh, so we've got some tools on the website, thank you mentioning those. But we also do search, I write a think called the, the multi-asset letter. And that's stats. You know, obviously I use some of the tools that we've built, but there's also, you know, proper fundamental old school kick the tires analysis, what's in the etf, what do the individual securities look like, what's the, what's the value and so forth. And I like dividends and, and please elaborate. Tell you why. And back 19, I think I loaned dividends and maybe I was, maybe I was a bit lucky I didn't predict covid, but I was very skeptical about income funds at that time. You saw a lot of companies, you know, with these, um, overly high payouts, the foot, do you remember the Fusi was very criticized for having all these big dividends Yeah, yeah.

Charlie Morris 00:16:29 For these companies that couldn't quite manage them. And then Covid came along and it was an excuse for everyone to cut their dividend. Not just here, but everywhere. And, and, and, and, and, um, income funds, you know, were absolutely, uh, destroyed over, over Q2 or q1, Q2 of 2020. And then, you know, when you flush out the entire dividend system and companies, even companies that didn't actually need to cut their dividends did it anyway. Um, what what comes outta the other side of that is, is dividends are probably pretty damn rock solid across the board. Yep. Uh, and that will last, that's a force that's gonna last a few years. And so these, these income funds and dividend ETFs, um, I always bit skeptical of them at that time. Could Wood Woodford was of course a big casualty of, of the income fund. Um, and I think it's a really good time to be looking at dividends because they get you into value.

Charlie Morris 00:17:21 They keep you out of growth, they keep you out of defensive, you know, what's done too well in the last two years. These sort of big, big defensive stocks and um, uh, uh, and gold possibly. And, and some of these, some of these things. And the dollar has done too well in recent years. And, and those are probably the areas you don't wanna be. So if you can get the value and get to the dividends knowing that they've been flushed out and they're back on the way up, um, that's what I think is gonna work well, regardless of where the economy's really strong, already weak, I doubt it's really strong, but I think it might not be really weak. And therefore, you know, being paid away in undervalued stocks that can appreciate it a little bit and you get paid, you know, decent coupon each year. What's wrong with that?

David Stevenson 00:18:01 Well, and in fact, I mean, I, I'm a big fan of dividend Arista crafts, this idea that you invest in companies that have consistently prioritized dividends over progressive dividends over a long period of time and just patently just keep sending the checks out. And in fact, in us, which is not a big dividend paying culture, um, you know, Europe's a much bigger dividend paying culture. But in fact, if the, you look at US ETFs actually dividend aristocratic ETFs or, or, or, or more complicated dividend screens than just a simple, I'll buy the ch the biggest dividend yield they've done, they did really well in 22. Um, a and there's no reason to think that they won't do well along with buyout orientated, sorry, buyback orientated DV ETFs, which is roughly the same kind of idea. Um, one, one other, I suppose they're just two, two questions before what we finish off with, with the inevitable question about crypto.

David Stevenson 00:18:47 Cause we're, we, we can't not talk about crypto particularly as you have a ETP that looks at the, is on the relationship between gold and, and risk weighting and, and bitcoin and, and that kind of stuff. Before I get there, there are two things. Um, one which is both equity orientated, both secular themes. So one tech and the other one is the kind of energy transition, industrial metals, decarbonization, reindustrialization, whatever word you wanna use for it. So let's look at tech for instance. First we, we started off talking a bit about the big tech ofs. Um, is it important to distinguish, do you think, between tech companies that actually are producing substantial learnings and I'm doing reasonably well. It's an argument I would make that there, there's a, there's a small handful of companies like Alphabet or Google, like Microsoft that actually do make shed loads of money.

David Stevenson 00:19:38 Yeah. A a and they've made a bit less money because they're being hit by digital advertising, but they, there's some deeply profitable businesses. Yeah. And then there's a longer tail of tech companies. I mean, there's some shocking statistics about the number of companies, small cap tech companies for instance, or mid-cap tech companies in America that don't produce any profits. Yeah. Um, and the longer teller companies that frankly never will have never produced, oh, my phone's going. Um, have, uh, the, the rookie era of all podcasts, um, that have never produced, uh, profits and certainly never produced cash. And, uh, once you distinguish between the, the cash generating tech giants and the rest,

Charlie Morris 00:20:16 Absolutely. They're completely different animals. And I think that's another reason to be bullish. Your, your opening question was why you, you know, why are you bullish? And if you take, um, ark the, the Kathy Woods, uh, yeah. Nonprofit tech stocks or the Goldman Sachs nonprofit tech index or whatever. Yeah, yeah. You know, it's back to where it was five years ago, it went through around

David Stevenson 00:20:36 60, 70%. Yeah, yeah,

Charlie Morris 00:20:37 Yeah. It went through the roof, it went all the way up to the moon and it's back, come back down again. And so we flushed that out. And when did it peak? It peaked in February, 2021. So that's just under two years ago. Two years is a long time for a stock market to adjust. Yep. Um, the average age for a bear market is 14 months. The really bad one's gone for three years, but, you know, two years that'll do. And so think you've had most of the, um, of, of of, of, of that reversal. And that's face it that, you know, most people will say happening that stocks like Peloton or Beyond meat went up 200 times or whatever on the back of stimulus checks and this sort of thing and covid and weird stuff. And, and that's all gone away. So, you know that that, and that money kind of rotated into the big tech that you described with loads of profits into, into, into Apple and Google. And, and that is where I see the, the, the, um, remaining high valuations. And that could take years to unwind. These dogs don't have to go straight down, they just have to go nowhere for years.

David Stevenson 00:21:39 Yeah. No, well, meta is a good example of that. Um, I, and I think the, I I guess you'd be right about this week, but I think that the, the canary in the coal mine is biotech. Cuz biotech also basically went into a swoon about February 21 in fact, and has spent the last two years going nowhere. And there, there is some evidence now that, that we've, that we're beginning to see a kind of culling of the companies. You're beginning to get valuations, you know, back down below net cash rabbit. So I, I would suggest that people look at biotech as particularly one area where the, if that turns, that's a, that's a sentiment indicator. The other one I wanna talk to you bit about decarbonization, this whole kind of industrial metals thing. It's come back again in the last couple of months and it's very much powering the miners.

David Stevenson 00:22:20 Yeah. So I watch, you know, funds like BlackRocks, world Mining Fund quite carefully, big co a big con, a big kind of a glomeration of the big mining names. And, um, it had a bit of a rough patch at some point in 22 it sort of come back around again. And, and, and in the New Year, predictions, uh, uh, there's lots of people including me saying that, you know, industrial metals, um, everything to do with this kind of, you know, decarbonization, reindustrialization, retooling, everything. That's a big secular long-term ball theme. It will be volatile. But it's an interesting theme. Do you buy that argument?

Charlie Morris 00:22:53 Yes and no. I mean, uh, if I just go to biotech, I'm glad you mentioned that cuz that recently went in our portfolios.

David Stevenson 00:23:00 Oh, right. Oh, good. So we

Charlie Morris 00:23:01 Agree biotech was, cause biotech peaked in 2015, as you remember. Yeah. And there was, and that, uh, fairness, the, that

David Stevenson 00:23:09 Fair enough. Yeah. Uh, Elizabeth Hong,

Charlie Morris 00:23:11 That sort of thing. And today the biotech index is roughly the same level as it was eight years ago, but the sales price is high. Yeah. So it's a classic, um, growth sector that has grown into its price. Yeah. Um, on, on the, on the, the commodities, the metals in particular, I suppose I am in the long term bull argument, but I wouldn't say our exposure is particularly high at the moment. It's not zero, but it's not particularly high. It was high, um, 18 months ago, two years ago. We've taken a lot of profits out of commodities. And I'm sitting here right now scratching my head whether that's, whether that's wrong. You know, should we be thinking about precious metals with industrial metals? That's one of the big questions. You know, are we getting full signals? Um, or, or, or, or not. But I say the other point is that if you look at the World Mining Index, um, it's the, it's the same level as it was in 2011, just like markets and all that. So they all go together. Europe, uk, Japan, emerging markets, mining, energy, all of these things have just done nothing in a very long time. And I think if you diversify and put 'em all together in the pot and diversify, you'll be fine these next few years.

David Stevenson 00:24:17 Yeah. Okay. I wanna finish on, um, <laugh>, arguably some would say the, we mentioned Kathy was an ark and, and the, the, and the kind of food tech guys that blew up. Well of course the big blurp in the last couple of months has been crypto, hasn't it? Um, a spectacular blowup. Um, now I, I think we would both agree from different ends of the argument that it's different than the other tech company. It's a tech, uh, sectors. It's got different dynamics. Um, a and in fact your E T P, which is who 21 shares, sort of looks at the dynamic, which is that relationship between gold and crypto. Because of course crypto is also an expression of people's desire to get away from monetary fear to money, fear. So there's lots of other things going on in crypto than just the sort of straightforward tech bubble. Um, are we at the trough?

Charlie Morris 00:25:04 I think so. I mean, let's break this down. I mean, if you go back to the 2013 high, which was a thousand dollars to keep it simple and the low is $200, again, rounding, rounding numbers. So that's an 80% fall. And then it goes up a hundred times for 20,000 and it falls for 3000 and then it goes to 68,000 and falls to 16,000. You know, 16,000 is roughly where the high was in 2017. So you kind of had a slap period over five years and it went to 20,000, actually went to 19 something, but it was only there for a couple of days. And so, um, you know, it it it's just done. What it has does every fourth year you had this four year cycle that seems to keep on coming around every, every, every up here in the four year cycle. What you can read about is how the four year cycle's never coming back, and then it comes straight back <laugh> <laugh>. And so, and it, it probably relates to the Harvey cycle. We'd, we aqueous supply halves in, uh, April next year. So, you know, if it was stupid and dead and worthless then, then it would be stupid and dead and worthless.

David Stevenson 00:26:10 And can I just ask on that point, the stupid dead and worthless argument. Uh, I, I've been wrestling with this and lots of people have been restless. I mean, Noah Smith, the Bloomberg economist, wrote a really good piece about it, um, saying, you know, is it fundamentally a pointless exercise? Yeah. Because if it is a pointless exercise and it could go all the way to zero and, and no Smith is by no means are not a, a, a supporter of, of crypto, I think made some very powerful arguments I'd agree with, which partly we look at things for the, the, the prism of the developed world. If you live in Zimbabwe, Venezuela, the other countries, you probably think it very differently. Um, there's also the fact that there's this whole, you know, decentralized finance stuff. I is is the use case still there? Both as a currency? Yeah. Because it's, it's got its currency, uh, kind of functionality and then it's got, its kind of defi, you know, wider system functionality. Are both of those, uh, foundations still there?

Charlie Morris 00:27:05 There there's a lot going on. There's a lot going on in crypto. And um, I would say that going back to the beginning, we just had this attempt to replicate gold, um, over the internet digitally. And blockchain enabled that to happen. You know, what is gold? Gold is the original FinTech. I mean, gold, you can make the same arguments about gold being pointless. Um, but for 5,000 years

David Stevenson 00:27:29 His and Warren Buffet has made that argument. Yeah. <laugh>.

Charlie Morris 00:27:32 Yeah. I mean he, and he does that very amusingly, you know, you go to Africa or someplace and stand around, um, the, the, the, the vault and guard it when it's just been in the ground for thousands of years. Fine. But he's also made the argument about Bitcoin. Where, where he, where he showed why he didn't understand Bitcoin. Cause he said, I wouldn't buy all the Bitcoin for $25. And I went through his accent again. Now, why would it be a really bad idea to buy the Bitcoin? Because you destroyed the network. So the intrinsic value of Bitcoin is zero. Okay. That's obvious. But the network value is enormous. Yeah. It's a bit like if you go onto, uh, uh, WhatsApp or, or whatever have you, if you owned all the accounts, so you'd only text yourself if you owned all the telephones. You can only call yourself the idea, the value in Bitcoin is his ability to exchange with others. Yeah. And that is hugely valuable. And we look back at things like WhatsApp, um, when Zuckerberg bought it, you know, 10 years ago for 18 billion, the time he went, God is crazy. And nowadays everyone thinks, I wish I'd done that.

David Stevenson 00:28:34 Yeah. I was about to say, yeah, what a great investment. I personally think that's the most valuable bit of his portfolio at the moment. Broadly.

Charlie Morris 00:28:40 Yeah. And, and so this idea of networks which have been enabled by the internet, um, are are extremely powerful. And to your point, you know, some, if you're living in Venezuela, you have a different opinion of Bitcoin. If you, if you're, uh, if you're in Nigeria or Ukraine, Russia, you might have a different view. If you're living in a city like, uh, like London, New York, Tokyo, you, you would have a different view. And you might see it as pub, you know, pub of speculation. But, but that's fine. That provides liquidity. Other people will see it as mathematically important. Others would say it's a, oh, what, what, you know, what do we do with surplus wind on a windy day? You know, you can't, you can't stall the surity. Oh, but we couldn't mind Bitcoin. We could store the money. Uh, and that would, that would be useful for, for funding green projects. You know, this idea that we could actually have cyclical demand for energy useful to non for energy. There are so many useful things about it. And then you've got clever people like, um, Alan Howard, and I think many people would think that he was stupid. Uh, he's a big fan of

David Stevenson 00:29:37 Bre Howard,

Charlie Morris 00:29:37 Of Bre Howard, you know, he multi billionaire. And, and he, he, he's got a big bet on this space. Cause he thinks it's how the future of the financial system will operate. Mm-hmm. <affirmative>, and, and I share that for you. I think that, that what we are doing is we're building something. It is wild west, but that's the regulator's fault. It's government's fault for staying out of the way and just trying to shut it down and failing by the way. Yeah. Um, and, and so what you, what you, what you've got is a is, is, is a potential to have the tokenization of everything, every bond we've discussed, every currency, every share, every ETF will end up being tokenized in some way, will be driven by this space. Your har Hard Landsdown or AJ Bell portfolio, um, will be, will be backed by crypto. I'm, I'm not talking about big, uh, I'm not talking about Bitcoin. I'm not saying everyone's gonna Bitcoin no infrastructure around that. The digital,

David Stevenson 00:30:24 This decentralized finance, the this kind of this and Web three and various other terms that get used to describe it. So you still think that that, that that functionality, that foundation is there.

Charlie Morris 00:30:35 I think that that's the end game for this. And you know, it's obviously not ready today. It's, they're obviously not ready today, but, um, it's pretty impressive what's happened. And many of the skeptics, you know, Isabella Kavinski from the Financial Times, who's now dependent, you know, his, she's changed her tone from just sort of laughing at it to being pretty constructive and saying things like perpetual swaps are really quite impressive that come out of the, you know, he's been lots of innovations, uh, in crypto that have been amazing, but all the things that have gone run wrong have been bad people.

David Stevenson 00:31:07 Yeah, yeah, yeah. And that's good. And by the way, that, that could beru equities, so, you

Charlie Morris 00:31:12 Know, systems, it's, it's been bad people. There's a real shame. And, you know, regulators, I think that if they embraces the bill little, um, there's, this is a classic, you know, if you go back David to the nineties, you know, all I remember is, you know, people sort of turning their nose up at these internet stocks, <laugh>, of course it was amusing that pet stock on was worth a trillion dollars or whatever. I mean, of course it was quite funny, but, and, and ridiculous at the same time. But everyone knew it. Um, you know, no one took it seriously, but everyone knew that it was going somewhere. There was a vision of, of where this internet thing would would go. And it just went much further than we ever thought it would, would, you know, it's, it's, the internet today is much better than we ever thought it would be back in the late nineties.

Charlie Morris 00:31:57 And so I think that's quite an important, um, uh, point. But, you know, back then people would say, oh, I like the internet thing, but I don't like these internet stocks. And today that you'll hear 'em say, oh, I like the blockchain, but I don't like crypto. And you say, well, how are you gonna get crypto without, how are you gonna get blockchain without crypto? These are the projects you, blockchain doesn't build itself. It's people, it's innovation, it's teams. Mm. Um, uh, and why have we got crypto? This is the final point. You know, you probably wish you'll never ask me about this David in a minute. <laugh>. But, but, um, but, but why have we got crypto again, regulators? I mean, how many stocks did we have on the London stock market 20 years compared to today? How many stocks were in the US stock market compared today? I haven't got enough on the top of my head, but I think we're about

David Stevenson 00:32:41 There, there, there were a lot more <laugh>, there

Charlie Morris 00:32:43 Were a lot more stocks back in the day. And, you know, if you were a youngster with a project and a bit of, uh, uh, entrepreneurial spirit, you could go and get an I P O where you could find your company, you could do it, but now you can't. Now you need sort 10 year track record and the E es G 15 pages on your policy. Yep, yep. You know, board of diverse people from all over the place. And it's just absurd. You know, you're trying, you, you're trying to build a young business and you've got this sort of, you know, this huge burden to, to comply with. You'll never get IPO away as a, as a, as a young, enthusiastic entrepreneur. And indeed all the great companies that come through Silicon Valley that didn't even hit the market until, until there were tens of billions. Yeah. So the world's changed. And crypto still offers a young entrepreneur an opportunity to, um, get cracking.

David Stevenson 00:33:27 And I must admit, the, the, the, the where I sort of end up agreeing with you is, is that capitalism has a fantastic track record of throwing money and very talented people at something, of which 95% of it is in is completely rubbish. Never gets anywhere, fails, never generates any profits for anybody, but the 5% sticks to the wall and the 5% grows and grows and grows. And that's the internet. That's, that's, that's pretty much every big capitalist created destruction impulse. Yeah. Capital. Phenomenally good at that. And, and the, the, the, the trick is to know, um, to know the businesses that succeed, but if only we knew the answer to that one, Charlie, then we'd all be very rich. Each two

Charlie Morris 00:34:06 Individuals made it be easy, wouldn't it? And everyone says they're go and choose the 5%, but the smart people don't even bother. They, they say, well, I know I can't choose the 5%. Yeah. So I'll try and get, I I'll go to the 30%. I'll just try and avoid the total rubbish, you know? Yeah,

David Stevenson 00:34:18 Yeah, yeah. Absolutely. And that's the way it works. Okay, Charlie, one last question then on the crypto thing. Um, this is my kind of left field question just to leave everybody with. What's one thing in the last three or four months, which, which has happened that you think is really interesting and that you would recommend that people just look at, take some time to look at it and think, Hmm, there's something there that's really very, very interesting.

Charlie Morris 00:34:44 So that's fine. I mean, there's so many things you, I could answer that, but I'm gonna stick with Bitcoin. Cause it's the big, it's the big one and it's the world's second most liquid alternative asset. It's value is its liquidity, it's value is its network. If it dried up and stock trading, it would be worthless. You can cut and paste the Bitcoin code, um, and, and you and I, uh, could, can launch our own, um, uh, a sort of crypto thing. No one would care. No one would trade it. And, and, and it would be worthless. But, but Bitcoin isn't because it's the one that's got that respect. So I'll go and look at our data, our live data on bike three.com and click terminal. It's free of charge. And watch that blockchain tick away. And you know, I I, I challenge you to think that thing's worthless. If you actually go look at this, look at the stats, look at it in real time. Crazy. Every day, every day. Ev every, every minute of every day. Uh, for 14 years, this thing is just purry.

David Stevenson 00:35:40 Very interesting. Charlie, Charlie Morris , thank you very much.

Share this post