The latest episode of my Adventurous Investor in Conversation is with the excellent Joachim Klement, a strategist at investment bank Liberum. He also runs a superb blog Klement on Investing which I thoroughly recommend. Joachim is a font of knowledge about investing, drawing on academic research and translating it into easy-to-understand concepts all investors can grasp.

Our conversation is in two parts – today’s episode is on investing principles. In the episode above we discuss what the weight of academic research tells us about investing and how that analysis informs some basic investing rules. It’s an excellent primer on how to invest properly – obviously with no investment advice intended!! The second part will be released on Friday and features a long discussion of ESG investing, which I am deeply skeptical about, but Joachim is more receptive to.

One note on the recording – because of a stupid technical snafu on my side, there’s a tiny echo on Joachim’s side. It’s absolutely not a problem to listen to but not ideal. Enjoy!

Note 1: Literacy Capital – Deal validates existing track record

A few months ago I drew attention to a small listed private equity investment trust called Literacy Capital that invests in small to mid-cap UK private businesses. It’s in effect an outgrowth of the Paul Pindar family office and has quietly built up a striking track record on realizations. Moving forward, talking to the principals behind the fund – where they are very heavily invested – I was struck by how optimistic they were about deal flow in the next year.

Since then the shares have slipped from a chunky premium to NAV to a small discount of 6.3%, with the market cap of the fund at £236m on a share price of 394p. The good news is that the deals keep coming in, proving their existing portfolio valuation.

The latest news is that the fund has sold a significant stake in Kernel Global to Three Hills Capital Partners”.According to fund analysts at Liberum, this deal “values BOOK's stake at £28.6m, representing a 3.7% uplift to NAV. BOOK will receive £19m in cash, which will be used to repay the RCF and make additional investments. The sale represents a 9.8x net return to BOOK and a 6.7x cost based on cash proceeds. The original investment was in 2018. Kernel Global was BOOK's fourth-largest investment, at 7.6% of NAV, as at 31 December 2022. The company is involved in the recruitment ecosystem.” Kernel was Literacy’s fourth largest investment (equating to 7.6% of NAV).

Literacy says it intends to use the cash proceeds to repay the amounts drawn under its Revolving Credit Facility, before recycling these proceeds into new investments. It says “this [deal] represents a highly profitable and successful investment for Literacy, demonstrating the team’s commitment to actively managing the portfolio and recycling proceeds to fund new investments in the pipeline.”

I think Literacy Capital could be a great long-term investment but I’m ever so slightly wary on the timing front. Sentiment towards private equity is still very poor and although the fund has slipped to a small discount, that 6% discount is minuscule compared to the huge discounts at say Oakley Capital Investments (which I also rate very highly). That said, Literacy Capital is absolutely a fund worth keeping a very close eye on.

Note 2: Plus 500 – still a great hedge against volatility!

I’ve been quietly adding to my holding of Israeli-based, London-listed ‘fintech’ platform Plus500. I don’t plan to explain too much about this platform as I think most readers will have heard about it by now – it’s a leading spread betting platform that has been expanding into new geographies and verticals (share dealing). A particular focus is on expansion in the US where Plus500 has been steadily building its franchise.

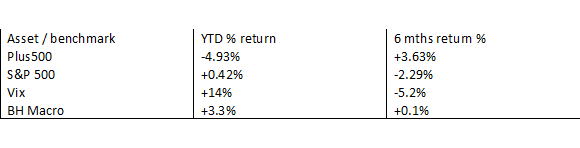

My investment logic is also very simplistic and built on two arguments: the shares are a play on volatility and the business churns out cash. On the volatility point Plus500 tends to make much more money when markets are turbulent, whipsawing up and down on fear of regime change. The more volatility, the higher the trading. This relationship doesn’t feed through directly into the share price though as you can see in the table below – year to date the Vix is up 14% while Plus500’s share price is down 4.93%. On a side note BH Macro – which is a more obvious play on volatility than Plus500 - has produced better numbers than Plus500.

Another reason for investing in Plus500 is that it produces a huge amount of cash. At the moment the business is sitting on $930m in cash, much of which is needed as regulatory capital. Last year it produced over $450m in cash - a fair chunk of that is returned to investors by a regular share buyback programme.

Key numbers:

Ticker: PLUS

Share price £17.16

Cash $930m

FY 22 Sales $832m

FY 22 Netfree cashflow $454m

FY 22 Valuation : £1.6bn

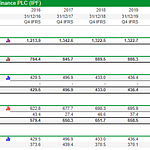

Recent results for the year ended 31 December 2022 were also impressive – the headline numbers are in the table below.

Plus500 Financial Highlights:

Here are some key headlines for the year plus500 which was headlined by strong revenue and EBITDA growth:

• Plus500’s ongoing ability to attract and retain higher value, long-term customers is evidenced by:

- 87% of OTC2 revenue derived from the Group’s customers trading for more than a year

- Consistently strong levels of Customer Income3

- Record annual ARPU achieved during the year

• The Group reached another major commercial milestone, with over 24 million worldwide customers now registered on its trading platforms since inception, providing significant potential value for Plus500 over time, through utilisation of new proprietary retention, activation and monetisation technologies

• Customer deposits increased to $2.3 billion (FY 2021: $2.1 billion), with average deposit per Active Customer growing to a record high of approximately $8,000 (FY 2021: approximately $5,000), highlighting on-going customer loyalty and confidence in Plus500

• In FY 2022, over 85% of the Group’s OTC revenue was generated from customers which used Plus500’s OTC platform on mobile or tablet devices and over 82% of OTC customer trades took place on mobile or tablet devicesSignificant progress made in accessing the substantial institutional opportunity in the US futures market:

• New B2B business line with major revenue opportunity – in addition to Plus500’s long-standing proprietary B2C technologies and offering, the Group has established a new commercial model, business vertical and strategic position developed by the Group as market infrastructure provider, delivering execution, clearing and brokerage services for institutional clients

• Outstanding achievement in FY 2022 in becoming a full clearing firm member of the CME Group exchanges and the Minneapolis Grain Exchange (MGEX). This extensive range of clearing capabilities will help to deliver the substantial potential opportunity for Plus500 in the US futures market

US gas play: CNX Resources

Regular readers will possibly remember that I own shares in US unconventional shale operator DiamondBack. I absolutely concede that natural gas operators are still involved in a carbon-intensive industry, but in my view, natural gas is a stepping stone energy source on the way to a net zero economy. On that theme, I have another potential business worth examining: CNX Resources.

A few weeks ago I attended the annual investor meeting held by Phoenix Asset Management – I’m a non-executive director of the Aurora Investment Trust, a fantastic, largely UK-focused equity fund managed by Gary Channon. Phoenix also runs a few other investment funds including the listed Castelnau fund – again, where I am a non-exec – plus an innovative global equities fund called the Huginn Fund which is managed by James Wilson, one of the firm’s partners who has been with Phoenix since 2013. Building on Gary Channon’s long-term, value-driven approach according to Phoenix, “ James looks to identify wonderful businesses managed by honest & competent management in both the UK and abroad. Once identified, James waits patiently for an attractive price at which to invest.”. You can find out more about the fund HERE.

At the event, earlier this month James presented his latest conviction holding =- I think it’s his largest from memory - CNX Resources. I’ve just started to have a look at this business but from what I can see so far, this does look like a classic ‘compounder’ business, built on solid financials in a volatile industry.

In terms of reserves, the business is entirely focused on the Marcellus and Utica shale acreage in Pennsylvania, West Virginia, and Ohio. CNX’s core sweet spot is in Southwestern Pennsylvania and on paper, the business has 15 years of production inventory at the current run rate of 25 new wells per year. On a side note, the Marcellus basin is potentially world-class: the most recent EIA estimate for the Marcellus shale resource is in the area of 450 tcfg (trillion cubic feet of gas). For reference, the largest gas field in the world is estimated to contain 1,236 tcfg, which is the South Pars field under Iran and to a lesser extent Qatar.

The Canonsburg-based natural driller is led by CEO Nick DeIuliis who runs the company in a very different way compared to other peers - his mantra seems to be unusually conservative and prudent, building on the strategy outlined by CEO William N. Thorndike Jr., founder of private equity firm Housatonic Partners and the author of "The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success." This involves thinking about the long-term financial performance of CNX, not just quarter by quarter, which means that in practice the business hedges away its output over many years. DeIuliis also focuses on free cash flow and other financial metrics.

Share basics:

Share price: $15.5

Ticker CNX

PE: 15.55

Interest cover 20.3

RoE: 49.7%

2022 sales $3.9bn

2022 EBITDA $377m

2022 free cashflow $669m

proven developed reserves by 5%, or 315 Bcfe, to 6,221 Bcfe

2023 guidance EBITDAX $1.1bn to $1.25bn, total capex between $575m and $675m and free cash flow of around $375m in 2023 or $2.20 a share

forecast PE is 7.5

gearing 80%

The USP for CNX?

I’m acutely aware that the US unconventional energy space is a deeply turbulent one, with natural gas prices extremely volatile even on a day-by-day basis. This makes financial forecasting extremely difficult. There’s also the ever-present challenge of diminishing reserves - see below - which can undermine long-term assumptions about inherent value. That said, I think we can roughly list the USP’s of the business as follows:

1. CNX is producing lots of cashflow - CNX has Generated ~$1.6 Billion in Free Cash Flow since Q1 2020

2. The business boasts a conservative balance sheet with extensive buybacks and debt under control. Weighted average senior unsecured debt maturities of 6.5 years as of Q4 2022, $681m in debt due in 2026/27. Total debt: $2.18bn

3. Low cost production

4. Predictable revenues by an extensive hedging program: In 2023 around 80% locked in at $2.37 per mcf, in 2024 around 70% locked in at $2.28 per Mcf and over 60% through to 2026. Only falls off in 2027. Programmatic hedging strategy.

5. The business has been buying huge amounts of shares: CNX has repurchased 57.0 million shares for $868 million( since Q3 2020 at an average price of $15.24. 24% reduction in total shares outstanding since Q3 2020

One other angle that is worth noting is that the business doesn’t seem to be terrifically interested in exporting its natural gas from regional ports. Unlike many operators in its space, it has stated that it wants to focus on supplying to the East coast region by replacing other more carbon-intensive energy sources. Its mantra: “The CNX vision includes a robust strategy of using local production to displace foreign oil, build new industries, and revitalize the Appalachian region. “

Challenges?

The big obvious challenge here is that, as I said above, CNX is in a volatile industry. That scares off many traditional value investors although one suspects that its prudent financial approach might win over some investors. Above and beyond the industry dynamics CNX also faces some other headwinds. I’d focus on three:

· Output has been volatile – Output is currently running at 555 bcfe, but over the last few years its share price has suffered because a key bore in central Pennsylvania failed to produce the expected output. The business says these worries are now behind it and it finished 2022 with 580 billion cubic feet of natural gas production, down from 590 billion cubic feet in 2023 due to the challenges. As one report on the business noted “CNX, like all natural gas companies, has to drill and produce enough new natural gas to offset the normal drop in gas flowing from older wells. CFO Alan Shepard said weather and operational challenges in the hydraulic fracturing operation will make the first quarter its lowest production of all four quarters. Shepard said it expected to return to the average production around the middle of 2023.”

· Emissions: There’s no getting away from the fact that CNX is involved in the energy complex and thus isn’t likely to appeal to any investor with a strong ESG focus. But CNX is trying to improve its carbon footprint by reducing methane emissions which are down by 31% - the company says the Appalachian Basin is the lowest methane intensity basin in the US. The CNX vision includes a robust strategy of using local production to displace foreign oil, build new industries, and revitalize the Appalachian region.

· The shares are heavily shorted – 15.4% percent of the float is short, amounting to 25.6m stock. My guess is that the stock is widely used as a proxy for the gyrating natural gas price.

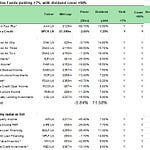

I’ll finish with Q4 update from the end of January which is summarised in the graphic below - the numbers seemed to be well received by Wall Street.

Share this post