Adventurous Investor in Conversation: David Cornell of ICG on Indian equities - what next?

Indian equities constantly amaze me. They’ve done very well over recent months despite all manner of headwinds, not least higher oil prices. India is also building up its tech hub status, moving upstream from its strengths in software and digitization to hardware and manufacturing.

But Indian equities also always seem hugely overpriced to this cynical observer. What should investors do Buy high or wait?

This week I caught up with David Cornell, of Ocean Dial who runs the India Capital Growth investment trust - compared to rival funds from Ashok, JPMorgan, and Abrdn, ICG is more focused on mid-cap local equities. As a listed fund it’s done terrifically in recent months (although the Ashok fund has been the undoubted star in recent years), so I thought now might be the time to catch up with David and find out what’s the next big story - and explain those high valuations.

Listen using link/button above….Please note that David’s audio is a bit fuzzy in places because of the internet but it’s completely listenable……

Valuing Spotify

The following statement from a recent Roundhill Music fund announcement caught my eye: “Streaming subscriber growth continues to be the fastest growing area of the music business, and this week alone Spotify grew its premium subscriber base by an extra 7 million in Q3 2022, 1 million above its target. Spotify, the largest of the streaming services, now boasts 433 million active users, including 188 million subscribers (an increase of 15 million so far in 2022), across 183 markets.”

So, to be clear, music streaming shows no signs of going ex-growth. Which should be great news for Spotify investors.

Yet Spotify’s share price has continued to head lower and it’s now worth about $15 bn. Turnover is likely to be around $11.7 bn in 2022 rising to $13.5bn in 2023. The business has in the past struggled to make a profit but in the last annual results had operating positive cashflow of $367m, free cash flow of $276m and cash on the balance sheet of $2.7 bn. Set against that is long-term borrowing of $1.78bn. Forecast EBITDA is likely to hit negative next year at-$316m (in 22) before moving into the positive at $69m in 23.

Putting a value on Spotify is a tricky exercise. Conventionally speaking even at $15bn it is overvalued as its struggles to make a profit. It generates lots and lots of revenue but gives the vast majority of it away to IP owners. Yet it is also steadily building its podcasting franchise and is showing some progress in incrementally increasing its advertising revenues as a % of total sales - though those numbers might be hit in a recession.

Conventional valuation metrics don’t get us very far with Spotify. I like per-user metrics such as Spotify is now worth around $75 per subscriber but that number is also frankly slightly meaningless. The only way we’ll break the logjam is to either

a) get Spotify to increase its net margin from those streaming revenues, possibly by renegotiating a deal with the IP owners or

b) accept that Spotify has huge strategic value to the right buyer who will want to access those users and deals.

I haven’t bought any more Spotify shares recently - and I’m sitting on a reasonably large loss on the old shares - but if the share price breaks below $75 a share I’d be tempted back in.

Literacy Capital

Last week I met up with the father and son team - Paul and Richard Pindar - behind the small listed private equity fund Literacy Capital. In a recent FT column, I was honest enough to say that I didn’t know much about this fund although recent performance has been excellent. Having dug around a bit more into the workings of the fund and met the key individuals I can say with some conviction that I am impressed though currently ambivalent about the price you pay for the shares.

Literacy Capital has a fairly unique strategy - its focused on UK small to mid-cap private buyouts where, typically, the family/owner wants some kind of realisation event but doesn’t want a ‘typical’ large PE transaction with all that that entails i.e stripping out cost, lots of rolling businesses into each other, putting on leverage.

Literacy Capital is very focused on the UK domestic economy and its typical ticket price for investment is between £2 and £10m. It also very carefully builds up the portfolio companies by bringing in expertise and investing in growth where necessary. In terms of peers, I suppose Oakley Capital does similar stuff but with much bigger tickets and across Europe while EPE is probably the nearest competitor - this listed PE boasts a very patchy track record, to put it mildly.

The fund came to the Specialist funds segment a few years ago and to date has a great track record and has consistently beaten its peers in terms of NAV growth - its increased NAV by 57% in the last year and over the last quarter increased NAV by 11.3%. Not unsurprisingly given these numbers, for many moons the fund also traded at a whopping premium though this was largely a function of a tightly held share register where the Pindars are big shareholders and deploying their own capital - Paul built up Capita.

Crucially the fund also has a close relationship with a charity - also run by the Pindar family - called Bookmark which provides reading and learning support to children. The fund donates 0.9% to the fund on an annual basis to the charity, alongside the management fee which is also 0.9%. There is no performance fee either - a big plus in my books. Crucially the fund is not terrifically keen to issue vast swathes of new shares to grow in scale - the founders seem happy to stick with their investment and use realizations (and leverage) to generate spare investment cash.

The current portfolio is valued on an EV/EBITDA multiple of 8x. According to house broker, Singers, the portfolio of companies should be able to generate earnings growth of 8-12% NAV growth PER QUARTER prior to multiple expansions and exits.

In stark contrast to the dire predictions of UK domestic economic gloom, the portfolio companies do seem to be trading very well with most of the portfolio reporting very good momentum. Over the last 12 months, those companies generated EBITDA growth of 40%+ pa (for each top 10 investment). According to Singers, virtually all performance has been from underlying earnings growth rather than any multiple expansion.

Crucially Literacy Capital is now trading at a discount for the first time in many months. On the screens, I can see a price of 379p versus NAV of 384.9p. By comparison, the average discount for UK listed direct PE funds is currently running at 21% if we include 3i and 29% if we exclude 3i.

That suggests to me now might not be the right time to buy the shares. Let’s assume that the fund continues to see progress in the portfolio companies even as the UK domestic economy slows down. That would suggest more incremental NAV increases over the next few quarters. The share register is fairly tight so I don’t see much liquidity in the shares and given the fund’s very low profile I don’t see a long queue of investors lining up to snap the shares up in an illiquid market.

That suggests the discount could widen as NAV growth continues. In that scenario, once that discount got into double figures I’d be a very happy buyer of the shares. To be clear, Literacy has a compelling strategy, and its unique structure means it has brilliant long term alignment with your interests i.e no performance fee, founders have put their capital on the line and are not keen to keep diluting in order to chase AuM. I’d ideally like to see how the portfolio businesses develop over the next tough 12 months but on paper this looks like an absolutely core long term holding when the price is right.

New Global equities fund from Ekins Guinness

In this newsletter, I frequently allude to the excellent asset allocation research by Charles Ekins of Ekins Guinness. His job day job, alongside running the top level macro numbers, is to run a fund that I have profiled before in my Citywire column - HERE. The existing fund is called the TB Enigma Dynamic Growth, and uses exchange-traded funds to make the key asset allocation switches.

Ekins is just about to launch a new fund called the TB Enigma Global Sector Rotation Fund which will be a global equity strategy that allocates to, and switches between, 11 Global Sectors. The Sector selection is actively managed but implementation is through cheap liquid global sector ETFs which reduces stock-specific risk. The logic for launching is that Ekins believes that different sectors are influenced by different factors.

“For example, there are obvious economic-based differences between Energy, Technology, Consumer Staples, Financials, Healthcare etc. These typically give rise to differences in Sector performance, which provides the investment opportunity that this Fund tries to capture. The Value and Trend characteristics of each Sector can be measured and compared. We already advise professional investors on Global Sector selection and already use this Global Sector selection strategy within the equity component of our TB Enigma Dynamic Growth Fund (which has returned 29.1% from launch in July 2017 to 27/10/22 and is ranked #22 over 5 years, #19 over 3 years and #17 over 1 year out of 151 funds in IA Flexible Sector).”

I have to say the timing of the fund launch is brave, given not only prevailing market sentiment but also Ekins Guinness's own bearish views but Charles reckons that he feels “the timing is good now that many equity markets have fallen this year (eg the S&P Composite is down 19% this year). Our Global Sector model is still fairly defensive, focused on Healthcare, Energy, Industrials, Financials and Consumer Staples. Having favoured Technology for a long time before this year, we have been cautious about Technology all year. At some point, there will no doubt be opportunities to rotate back into the “growth” sectors such as Technology and Consumer Discretionary.”

The Fund is available through platforms, through T. Bailey Financial Services or via application forms on their website.

Amedeo Air Four Plus Ltd (AA4)

Last Friday I noted that Elliott has been busy snapping up shares in the various Doric Nimrod funds - now it’s also been revealed that it’s also bought a chunky stake in AA4, the Amedeo fund, ticker AA4.

This is currently trading at around 34.5p a share, with a dividend of 5p a share paid quarterly, which equates to a yield of 14.2%. working out what AA4 is really worth is a difficult exercise, full of lots of details and uncertainty.

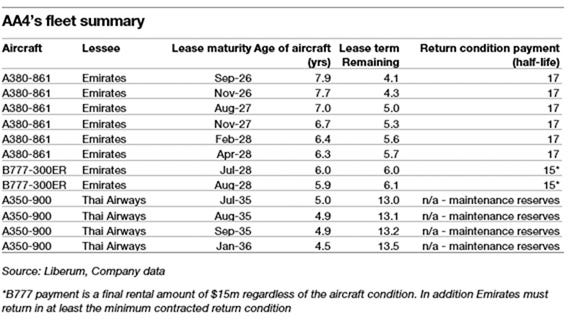

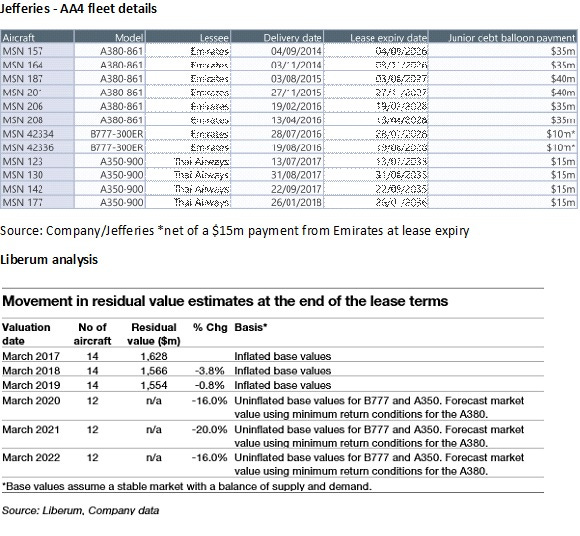

The key variable seems to be what the terminal value of its big planes might be when they come off lease to either Emirates or Thai Air (the latetr had gone into administration after Covid). So, what’s in the portfolio?

This currently comprises 12 aircraft at 31 March 2022 - six A380s (leased to Emirates), two B777s (leased to Emirates) and four A350s (leased to Thai Airways).

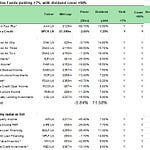

Using broker’s reports from Liberum (the house broker) and Jefferies, these are the various bits of the puzzle I have been able to pull together:

- The 5p dividend is backed by income from leasing out the planes to Emirates (A380s and 777s)

- Earlier this year Emirates agreed to acquire Doric Nimrod Air One's A380 aircraft for £25.3m at the end of the current lease term

- AA4's return-condition payments (half-life) for its A380 fleet are $17m. In relation to AA4's A380 aircraft, the lease return compensation and redelivery costs are much lower than $30m (DNA1 A380 sale price) according to Liberum

- AA4 has previously reiterated its view that it does not expect to receive any income from the Thai aircraft after expenses and debt service costs, but there is scope for the recovery of equity value. The airline is making power-by-the-hour (PBH) payments in 2022 before switching to a fixed payment from January 2023. The PBH payments have been sufficient to cover the quarterly interest and expenses.

- Thai went bust but has renegotiated its deal with AA4, committing to a six-year extension on the leases, taking them to 2035/2036, with a debt refinancing due to take place on three of the four aircraft at the point of the original lease expiry in 2029.

- The Emirates-leased A380s and 777s are generating income, but potentially have no equity value. The six A380s have junior debt balloon payments of either $35m or $40maccording to Jefferies. Jefferies analysts reckon zero valuation is “overly prudent” and they have modeled residual values of $25m for each of the A380s (i.e. $15m to equity).”

- current residual cash of £43m, or 12p per share,

So where does this leave us in terms of final valuations?

According to Liberum, in July 2022,” based on relatively conservative assumptions with respect to AA4 (no equity value for A380 after debt repayments and $12.5m for A350), we estimated an IRR of 14% from a 32.5p share price.” An older form a few months ago following results states: “We believe there is potential for an increase in distributions over time as we estimate recurring earnings of £26m (vs. £17m of annualised distributions). We believe AA4 is gradually building up cash reserves within the A380 SPVs, to ensure there is enough capital to meet obligations on the junior debt. Even on relatively conservative assumptions (no equity value for A380 and $12.5m for A350), we estimate an IRR of 14% from the current share price.”

Jefferies's take isn’t radically different:

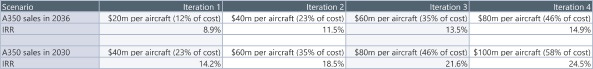

“IRRs are understandably heavily contingent on the timing and size of the A350 sales proceeds, ranging from 8.9% to 24.5% under the various scenarios. Notwithstanding these high returns, there are still sources of potential upside. For example, cash could be returned earlier, either in full or in part, and/or some equity value could accrue on the A380s.

Exhibit - AA4 scenario analysis for A350 sales

Source: Jefferies

So, in essence, this all comes down to two issues

1) whether the Emirates planes have any residual capital value. Possibly/probably not but maybe there is some upside?

2) The value of those A350s being sued Thai. According to Lberum they’ve seen these planes “transacted at c.$100m in sale-leaseback transactions. Jefferies also warn that “it is currently unclear whether the A350s will generate any income after debt servicing costs in the 2030-2036 period. In the absence of net income from these aircraft, the fund as a whole would not generate any income given the leases on the A380s and 777s would have by then expired”

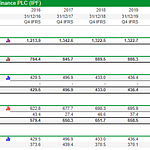

The two tables below put some more flesh on the bones of valuations of those plans and debt repayments.

I don’t have any firm conclusions except to note that Elliott is a canny operator and almost certainly didn’t buy into AA4 based on what I would call the base case scenario - this is that there is no residual value for any of the planes and thus all you can really rely on is the income stream of dividends for the next five to six years (which would probably only just about cover the current share price). Using the various scenarios mapped out by Jefferies I’d probably err on the cautious side, using a 2036 scenario with an emphasis on Iteration 1 or 2 which suggests IRRs of 8.9% or 11.5%.

Share this post