Adventurous Investor in Conversation: Craig Roberts on Vietnam Podcast on Vietnam

One of the few consensus calls within the broad emerging/frontier markets space is that Vietnam will likely be a big beneficiary of any reshoring/China decoupling trend. Its ideally suited to benefit from foreign direct investment looking for an alternative to China and also has a vibrant domestic consumer economy. At the geopolitical level, it doesn’t have any obvious Taiwan-style vulnerabilities - and in fact, many Taiwanese businesses are big investors in Vietnam.

To get a better take on what’s happening locally, earlier this week I caught up with Craig Martin from Dynam Capital which runs the fund Vietnam Holdings one of the biggest listed London funds focused on Vietnam. In the podcast we discuss:

- China decoupling

- The local real estate market

- Local consumer markets

- Valuations relative to other emerging and frontier markets

It’s well worth a listen and it’s a great background to why Vietnam is arguably the most interesting frontier market open to Western investors.

Google vs Microsoft

Mark Sheppard, the tech-focused fund manager at the Manchester and London Fund has just released a useful primer on the likely impending showdown between Google and Microsoft’s Bing over AIs and different chatbots.

“It is now a War. We see several possible outturns including:

IF MSFT start to gain traction with Search activity utilising Edge/Bing THEN it would be logical for them to apply pressure on GOOG with a view to making Search zero margin so they crush the "cash cow" that feeds GCP (GOOG's cloud platform) and hence MSFT becomes the clear No1 in AI. To do anything less would be negligent for Nadella (CEO of MSFT). Low to Medium probability.

MSFT makes little traction and GOOG holds on to its share of the Search advertising market BUT this will require a meaningful response to the threat from GOOG which not been seen as yet. As before, we would classify this response as a Required Action Point for us to continue holding GOOG. Medium probability.

MSFT gains traction in a cohort of higher educated professionals who switch to BING. This cohort tends to focus on Search for commercial, scientific, enterprise and work related matters. In time, the Search market splits into: Consumer controlled by GOOG; and Enterprise controlled by MSFT. MSFT strengthen their position in this Enterprise segment by integrating their AI search capabilities throughout their other Enterprise software applications. Low to Medium probability.”

For the record, I hold both Alphabet and Microsoft.

A new addition to the Alternative Funds Trading list - Chrysalis Investments

If you are brave enough to be a growth investor - a tough vocation in the current climate - then I think at some stage you need to have some exposure to the world of private businesses, preferably fast-growing ones which might turn into tomorrow’s tech leviathans. The best way to get this exposure is through a venture capital firm, a handful of which are listed on the London stock market. Arguably the most high-profile firm in this space is called Chrysalis Investments. I say high profile because it has been in the media for two main stories. The first was a massive row about the fees the managers generated when times were good and shares in the fund traded at a massive premium. The second story is that many of the key investments in the Chrysalis portfolio have had a horrible 12 months and have seen their valuations absolutely plummet. As a consequence, the share price is down 67% since its peak in September 2021, when the shares were trading on a premium.

At this point, I have to say that the controversy surrounding both the fees debate and the recent performance is entirely justified. The fee structure was clearly skewed only to the upside and made the managers a small fortune. In essence, the renumeration package was, in my humble opinion, indefensible. Thankfully it has now been negotiated. According to fund analysts at Numis the headline performance fee has been “significantly from 20% to 12.5%. Significantly, the high-water mark of 253p has been maintained and further protections have been put in place to prevent a repeat of performance fee payouts in the event of a subsequent NAV decline.”

As for the share price plunge, this was also warranted. Chrysalis focused on late stage, pre IPO firms - well known names include Klarna and Starling. The portfolio is a high quality one and I can see why investors got excited, but times have changed. There is close to zero chance of an IPO for a year or more and many late stage VC backed investments have experienced massive writedowns. Until very recently I was of the view that the whole VC industry was ins elf denial and was refusing to put sensible valuations on businesses. I still think this is largely true and but less so of late stage, post Series c 9and D) deals. Crucially Chrysalis has introduced much more rigour to its valuation process and its board is to be applauded for taking an active stance on howe to value private businesses.

My core view is that whatever number VCs quoted in late 2021 and the beginning of 2022, you should discount by at least 80% if not 90% to get to a sensible value. That’s still not true for Chrysalis - that would probably take us closer to 60p a share - but Chrysalis is much closer to what I regard as a realistic VC valuation. In sum the funds NAV was down 41% in the year to September 2022, predominantly due to the impact of a down funding round for Klarna (-56p), with the rest of the portfolio collectively down 46p, including write downs to Starling and declines in listed holdings (THG, Wise and Revolution Beauty).

The upside is that Chrysalis has a great collection of mature private businesses in sectors such as Insuretech, Fintech and Cybersecurity.I realise hardened cynics will rightly say these sectors were over sold and valuations got out of hand, but there is real disruption afoot in all three of these spaces and I think the long term potential for change is huge. And crucially many of these businesses are what I regard as high quality. Again according to Numis “as of 30 September, 35% of the portfolio was profitable, 32% funded through to profitability based on company budgets, and a further 14% have a cash runway of around two years. The remaining 19% were either expected to either be funded by Chrysalis or other investors, or will be sold.” I would cite one example - I bank with starling and having banked with many others, regard it as quite the best online bank. Its technology works, its accounts are competitive and its even communicative with its clients.

chart above - Chrysalis share price in black, 20 day moving average in red and 200 day MA in blue

The fund recently announced a 31/12/22 NAV of 128.3p, reflecting a 13.2% decline over Q4. Four holdings comprised an 8% decline in the NAV, with much of this driven by 'the external valuer and the independent valuation committee's transition towards a more market-based approach, and away from a price of recent investment approach' according to analysts at Liberum. FX detracted 2% from NAV. The portfolio's funding requirement remains c.£20m, against holding cash of £66m, or 9% of NAV.

Analysts at Jefferies observed that four key holdings drove the recent decline in the NAV: Graphcore, Wefox, Deep Instinct, Featurespace. They estimate the NAV to be around 127p at the moment. Even more recently Chrysalis announced that it has agreed to invest a further £20m in Starling Bank via a secondary market transaction as another shareholder (Jupiter) exits its position following a change in its investment policy. Liberum analysts report that as a a result of this transaction, Starling Bank will account for 15% of the portfolio vs. 12% as at 31 December. Chrysalis's liquidity position will drop to c.£61m, being £49m of cash and the remainder the listed holding in Wise. Liberum also reported that “were the independent Valuation Committee to apply the 'price of recent investment' approach to its stake in Starling, it would result in a "modest uplift" in the company's NAV vs the 31 December value.”

Fund Facts

- Price: 68p

- Ticker: CHRY

- Formal discount : -47%

- My own estimate of true underlying value in worst case analysis: 50p

Market Cap : £406m

Top Ten holdings:

- Starling Bank 20.6%

- Klarna Holdings : 19.1%

- Wefox 11.2%

- Smart Pension 9%

- The Brandtech Group 8.2%

- Graphcore 4.8%

- Featurespace 3.2%

- Tactus Holdings 3.2%

- Wise 2.7%

- Cognitive Logic 2.6%

My take: The chart above shows the share price for the fund since the start of the bear market - you’ll also see the 20 day moving average in red and the 200 day moving average in blue. The fund has traded as low as 52p, and if there is another bear push, we could see the share price push below 60p again. My own sense though is that we are not far from the bottom and although I have penciled in a worst case / base-case valuation of 50p a share, I think there is some evidence to suggest that the worst may be over for some - not all - of the companies in this basket. I should also emphasise that I highly rate both Starling Bank and Klarna - both are fantastic businesses with a very solid business franchises and real fintech survivors. There are risks of course with such a volatile fund but my own sense is that the downside is now more limited, the upside potential very substantial and there is much better board oversight of the valuation process. Buy with a target of 100p by the end of 2024.

A defensive play: investing in the Healthcare sector

The healthcare sector had a good bear market. Most healthcare funds – bar biotech funds – produced positive returns for 2022. And although healthcare as a sector has underperformed the market so far in 2023, many large healthcare firms like UnitedHealthcare are releasing more than decent numbers.

But there is a more important long-term argument for looking at healthcare as a sector. Although it contains within it a broad range of niches (biotech and data services through to old school big pharma), overall the sector has strong defensive characteristics in a slowing economy wracked by higher than expected inflation. As a broad sector it comprises lots of companies with resilient margins and high pricing power. I think this argument has best been put by StoneX’s spiky strategist Vincent Deluard who has crunched the sector level data. After his interrogation he reckons that healthcare is more recession proof, especially compared to everyone’s favourite defensive safe haven consumer staples. According to Deluard “pharmaceuticals have maintained 15-20% margins throughout the past 40 years. They have almost no exposure to energy and basic material costs: their main expenses are research and development, marketing, and lobbying….the US healthcare sector is [also] monopolistic or oligopolistic with great price-gouging pricing power. Inflation in drugs prices and medical services has been twice that of the broad consumer price index in the past forty years. “

I would also add that on most valuation metrics the healthcare sector doesn’t look too far out of whack in terms of valuations. Sure, the historic sector PE for say the US majors is currently around 22 – which is a bit on the high side - but that falls to a forecast 16.81 times earnings for 23. In sum, healthcare tends to outperform in a recession, has pricing power in a more inflationary environment, is benefitting from strong secular growth drivers (we are all aging !) and is nit egregiously over valued. So, if you buy into this thinking, what are your choices in funds land?

So, if you buy into this thinking, what are your choices in funds land?

Your first decision is whether to look at the broad healthcare sector including both biotech and mainstream pharma/health services or stick to one sub sector. Mainstream pharma/health services is more keenly priced (on a PE multiple) but is less exciting. Its classic defensive investing. Biotech by contrast is much more exciting and growth oriented but is volatile and risky. Personally, I have a preference for the biotech space as I think its now two years into a bear market and due a reversal but I entirely understand why defensive types might run a mile.

Within the biotech (and medical devices) space you also have an additional choice. Do you focus on ‘mainstream’ biotech and innovation firms or do you go all next generation and only focus on those funds with a focus say on genomics? In ETF land that probably is echoed in a trade off between the Invesco NASDAQ Biotech UCITS ETF (mainstream biotech) or iShares PLC NASDAQ US Biotech UCITS (also mainstream) and more innovative portfolios such as the iShares Healthcare Innovation UCITS or the Legal & General Healthcare Breakthrough UCITS ETF.

Next up you have to decide which geography to focus on. This is a simple choice - the US, Europe or the world. If you are focusing on biotech, then it’s basically the US and a long tail of smaller UK and European firms. In the ETF space, your default choice is a fund called X-trackers (IE) PLC X MSCI World Health Care while in the active space its Bellevue Healthcare Trust PLC and Polar Capital Global Healthcare Trust PLC. If you are thinking of investing in healthcare broadly (including biotech and big pharma) I think your best choice might be to invest at the global level, so you don’t miss out on innovative UK and Swiss firms. The main world ETF is the X-trackers (IE) PLC X MSCI World Health Care ETF.

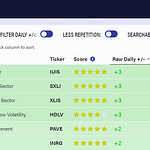

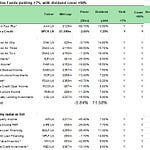

One last crucial question - active vs passive ? In the table below I have broke out performance for the range of ETFs and actively managed funds over various time frames starting from the last month to the last five years. I would make two observations.

The first is that by and large passive has performed as well as most active funds. There is no obvious active advantage at work. That said I think the Polar Capital Global Healthcare Trust has an excellent track record and has produced consistently great results. Its also prudently managed and has a defensive, income focus. Over in ETF land I also think the track record of the iShares S&P 500 Health Care Sector ETf, ticker IHCU, stands out. It invests in a deep, liquid pool of well run US businesses and this shows in the performance data.

In the next table below, I have broken out the top holdings for the iShares fund S&P 500 Healthcare ETF versus the Polar Cap fund.

Share this post