Adventurous Investor in Conversation with Michael Sieg: The renewables opportunity in developing Asia

First up we have a fascinating Adventurous Investor in Conversation podcast with Michael Sieg, the Swiss-based CEO of Thomas Lloyd, who also has a UK-listed fund called the Thomas-Lloyd Energy Impact fund, ticker TLEP - it just a few weeks back raised an additional $35m in equity.

I think that the renewable opportunity is absolutely huge in developing Asia and Michael talks through their core target countries: India, Vietnam, and the Philippines. We discuss why these markets are so interesting and the obstacles to progress in peers such as Thailand, and China.

My sense is that UK investors have been slow to grasp the sheer size of the opportunity and the margins on offer. Perhaps that’s because of concerns about corporate governance or just the usual domestic myopia. But if we are going to make meaningful progress on net zero within the next few decades, then the developing world is where the action is.

Have your voice in helping shape the funds you love

My colleagues at Doceo are launching what I think is a great idea - for full disclosure, I am an investor in Doceo. They are building an investor panel which can then form the basis of future focus groups for funds. The idea here is to actively canvas investment trust investors’ views about their favourite funds. If that’s reason enough (!) then Doceo will also be paying for investors to participate in their panels. Interested?

More information is below:

Doceo is a growing platform for investors to gather information and inspiration in the investment trust sphere. Short-format curated video interviews directly from fund managers provide invaluable insights into the inner workings of fund portfolios and the strategies under which they are being run.

Now, Doceo is providing a medium for you, as investors, to shape the future of investment trusts. This new initiative represents a unique opportunity to voice your opinion to key decision-makers within your favourite funds. Through surveys and paid focus groups, you can have a real impact on key issues within the trust.

Sign up here to be paid for your opinions. After all, they matter.

More listed VC red ink

The red ink continues to flow, with three leading listed VCs reporting numbers on portfolio valuations.

First up we have the poster child of UK-listed VCs Chrysalis which has reported NAV for the year-ending September 2022 of 147.8p, -15.7p, and -9.6% Q/Q (June 2022: 163.5p) and -41% Y/Y. As of 17 November, the estimated NAV is c.144p, a further reduction of c.3% from 30 September.

Matt Hose at Jefferies observes that Starling Bank looks by far the largest driver of the NAV weakness during the quarter, marked down by c.40%, and so appearing to reflect a £1bn valuation, down from £1.8bn on 30/06/22.

Next up we have Molten Ventures and their interim results which confirmed Gross Portfolio fair value decrease of -12%*, -17% gross of FX impact.

Last but by no means least we have US-listed VC Suro Capital which announced on Nov 8th third quarter numbers as of September 30th 2022. Net assets totaled approximately $221.8 million, or $7.83 per share, at September 30, 2022 as compared to $9.24 per share at June 30, 2022 and $14.79 per share at September 30, 2021.

So that is a near 15% decline quarter on quarter and a 47% decline year on year.

There are also some interesting comments from CEO Michael Klein , with my own highlights in bold:

“As we previously mentioned, the first nine months of 2022 were the worst for equity markets in the past two decades. Simultaneously, there is a continued dramatic slowdown in the IPO market, with less than 40 IPOs in the US during the third quarter and more than 60% of IPOs being withdrawn, year to date. As macroeconomic challenges persist, we expect continued acceleration in the repricing of private securities. We are beginning to see bid-ask spreads start to narrow as increased discounts are reflected in the asking prices of private securities on the secondary markets.”

I stick with my core view that we won’t see the trough until valuations are down at least 80 to 85% from the end Q3/Q4 2021 valuations. That’s probably still another 20 to 30% away from current valuations.

New retail bond…on PrimaryBid

The retail bonds market also known as ORB was one of those great ideas that never really took off! In Europe, retail private investors are huge buyers of individual corporate bonds, so the idea was that the LSE would provide a dedicated marketplace for individual issuers. Many years later and trading volume has shriveled and bar a few charities, there haven’t really been any big new issuers for years - with the exception of a few hardy pioneers such as LendInvest.

In an attempt to rekindle this market, the app-based service PrimaryBid has jumped into the market and offering investors access to a new issue of retail bonds by credit provider International Personal Finance PLC. What’s eye-catching about this new issue is the coupon- a mighty 12% per annum for the next five years.

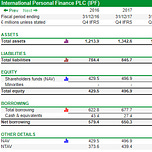

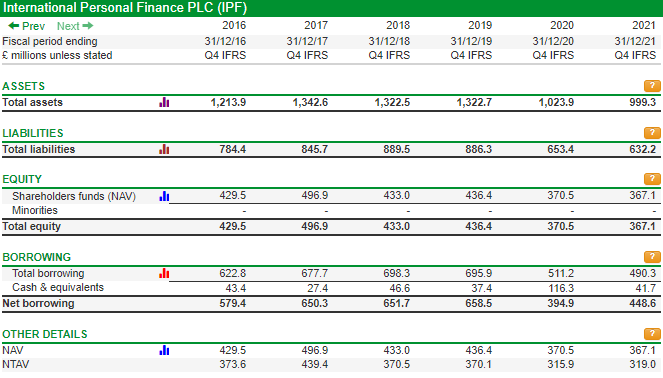

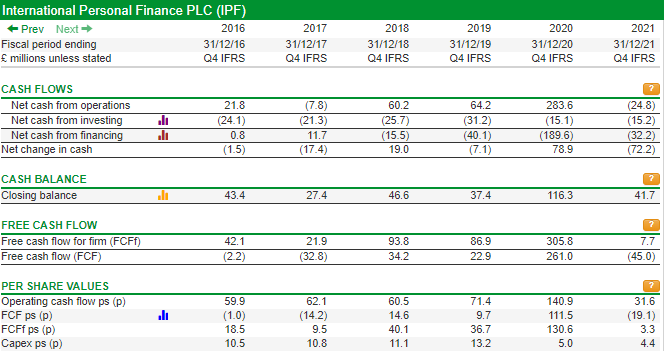

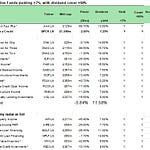

Their previous issues had been yielding below 8% so this represents a big jump - for fairly obvious reasons. Below you’ll see that I’ve included a couple of screenshots from Sharepad of IPF’s balance sheet and cash flow.

I make no comment on the issue except to say that 12% is certainly generous (implying higher risk, one would presume) and the balance sheet looks fairly manageable. The problem I suspect is the cash flow - especially free cash flow - which looks a tad anemic in my view. We’re heading into a global slowdown/recession in Europe and surely that must leave the business exposed to growing credit losses, especially in troubled East Europe. Again I am no expert on the business but one can see why this has a 12% yield.

Details of issue

Issuer? International Personal Finance PLC, the holding company for a global consumer finance helps people excluded from mainstream finance to access simple, personal, and affordable credit

Coupon? Senior unsecured Sterling-denominated notes due 2027 paying 12%. payable semi-annually in arrears on 12 June and 12 December

Redemption date ? 12 December 2027

Rollover for existing bond investors ? Yes. Existing Sterling-denominated 7.75 per cent. notes due 2023 (ISIN: XS1998163148) can exchange their 2023 Notes for new, retail eligible, senior unsecured 12 per cent. Sterling-denominated notes due 12 December 2027.

Settlement date? 12 December 2022.

Rating? The New Notes are expected to be rated BB- by Fitch and (P)Ba3 by Moody's Investors Service.

The New Notes have a minimum initial subscription amount of £2,000 and are available in multiples of £100 thereafter.

How to apply? The Primary Bid app

Share this post