How to invest in decarbonization with iClima’s Gabriela Herculano

A couple of weeks ago I caught up with iClima’s Gabriela Herculano to talk through the myriad ways that investors can put money to work in decarbonization. It’s a fascinating conversation where we range across a huge number of sectors. We talk about a huge range of practical issues including

- will carbon markets ever take off?

- How do we invest in new charging infrastructure?

- What do you think will happen to battery markets over the next decade?

- Beef RIP?

- How do developed world econopmies transition in the heavy industry concrete/cement sectors

iClima is a great research outfit cum fintech that also works with HANetf on a bunch of fascinating green ETFs. And Gaby is well-placed to talk about the whole decarbonization agenda from an investing point of view. She started her career in equity research, covering the Latin American electric utility sector at Lehman Brothers. After business school, she moved into the buy side, where she worked at Greenfield project finance and M&A at energy developer AES Corporation and as an Executive Director at GE Capital’s Energy Financial Services team in London.

More pain to come for the Listed venture capital funds

A few weeks ago - September 11th to be precise - I quoted a statistic that even I thought was stunning (as in stunningly bad). It came from VC-oriented asset manager Sparkline Capital - “Of the 1,495 US venture deals in the first half of the year, only 4.9% have been down rounds – a historical low!”

As I talk to VCs a few weeks later I’ve noticed a palpable cooling of sentiment although some late-stage deals are getting done. But I would say that we are only in the first part of the brutal recalibration of prices, with pre-IPO businesses bearing the brunt of the accounting write-downs. A useful measure of this is the valuation of Klarna held within the Jupiter/Chrysalis stable. According to Numis analysts in July of this year Klarna raised $800m at a $6.65 bn post new money valuation. The online start up news site Sifted has a wonderful explanation of what’s happened to Klarna’s valuation history - HERE.

“Founded in a tiny back-office in Stockholm by three young postgraduates in 2005, it had attracted funding from US VC heavyweight Sequoia by 2010. Fast forward 11 years to March last year when it raised $1bn at a $31bn valuation, becoming Europe’s most valuable startup. Three months later, it raised another $639m, bumping its valuation up again to $45bn and securing it the title of the world’s second most valuable fintech after Stripe (last valued at $95bn). But last month the tide changed for the BNPL giant, as a dramatic down round saw Klarna’s valuation cut to $6.7bn — an 85% drop from a year earlier.”

So, based on these reports Klarna hit a peak valuation of $45.6 bn in June 2021 and a little over 1 year later it gone down to $6.7bn. That represents an 85% peak to current valuation haircut. That’s a useful number - 85% - which we will come back to shortly.

What this story does tell us, is that when the valuation haircuts come in they are usually very brutal, and they start with the late-stage pre-IPO deals but then work their way down the ecosystem chain to the Seed and Series A valuations. Gone are the days when it seemed like virtually every start-up on Seedrs or Crowdcube with a decent business plan and a great deck was asking for a £5m pre-money valuation.

An excellent analysis of the VC market can be found in Ocean Wall’s latest monthly new ideas bulletin. They’ve used an overview by Check Warner at Ada Ventures as their guide. She’s currently running a series of videos talking about the feedback she received after interviewing a number of VCs and also some pointers on what founders should currently be mindful of before trying to access the market.

According to Ocean Wall “her observations include:

- VCs are saying they are open for business and writing cheques but reality shows that isn’t the case or that they are only writing for late stage.

- Series A bar is going to remain very high for at least the next 12 months.

- Series A focus switching to quality – particularly quality of team and quality of category.

- Series A – Revenue now important and a clear pathway to breakeven.

- Fund managers focusing on their own portfolio – looking at how to sell under or mid performing companies.

- Fund managers also working on down rounds for the later stage companies that have struggled to raise in this market.

- Growth market has been closed for last 2Qs.

- Emerging managers struggling to raise and so are scaling back deployment of capital.

- Due Diligence taking much longer as a lot of funds looking at Series Bs rather than Series As - they see more opportunities and better valuations there.

- Revenue and cash flow now matters more than growth. Series A -previously 3x year on year was typical – now that has fallen to 1.5x/2x – but need to show capital growth.

- A link to the full video can be found on Check’s LinkedIn feed – click here”

Let’s put this as simply as possible - we are only at stage 1 of a multi-stage, brutal cycle of valuation revisions that will see massive cuts in valuations for speculative private businesses. This process really only kicked off this year and will probably last for at least 18 months.

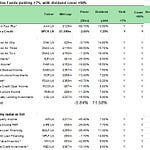

Given Warner’s comments above - and my own observations - it’s not surprising that the small handful of listed venture capital funds has suffered from huge price declines. The table below summarises the full horror of what’s happened so far, since the beginning of the year. Chrysalis is down 75% while Molten Ventures is down 70%. Yet even at these prices, these two funds trade at what seems like a huge discount to NAV: Molten is at 67% and Chrysalis at 61%.

But those discounts to NAV are using historic (many months old) valuations and its reasonable to presume that these are now way off the mark given the dire state of the market. The $64 million question is just how low can these valuations go?

In order to attempt any answer to this question, we have to start by asking how big a haircut on balance sheet valuations are needed for the listed VCs.

To help inform this process I’ve tried to pull together firstly the most relevant Year End 21 valuations (or thereabouts) for the main listed UK (and US VCs) plus the last /most recent stated or estimated (Numis) NAVs.

· Seraphim - estimated year end 2021 Nav 104p. Last estimate 98.7p (Numis). Change in NAvs -5%

· Molten Ventures - November 29th Interims NAV 887p, 31st March 2022 NAV 930p. Change Change +5%.

· Schiehallion - 31st Jan 2022 NAV £1.22. Last estimated NAV £1.30 (Numis). Change +6.5%

· Chrysalis - December 2021 NAV 237p. 30 June 22 valuation 163p. Change -31%

· Augmentum - 30th Sept 21 NAV 119p, 31st March 2022 NAV 130p. Last NAV July 22 155p. Change +30% since Sept 21

· Sutter Rock / Suro - 31st December 2021 NAV $11.72, last quarter NAV $9.24.. Change down 22%.

The mismatch between these NAV numbers - which are backward-looking and bound to be out of date - and the share price declines listed in the first table above, I think tells us everything we need to know i.e investors have already made up their minds about valuation cuts and ably deployed the red pen!

I would say that only Chrysalis and SutterRock/SuRo are anywhere near the mark on their likely portfolio valuations at this stage.

This brings me to where I think the landing point - the trough - for valuations might be. I was tempted to suggest a 90% valuation haircut from the end of December 2021 numbers. This was based on the premise that

a) that number sounded about right for an industry predicated on the ten bagger rule - if one firm out of 10 generates a ten fold return then why can’t nine firms out of ten lose nearly all their value and that one firm simply be worth what you paid for it?

b) That Klarna valuation cut - 85% - also influences me

c) If I’m honest as an investor it feels right to me that whatever number VCs come up with at December 31st 2021 at the height of tech mania, then we should lop 85% of that number.

d) Last but by no means least, in terms of peer groups, year to date the NASDAQ composite index is down 31% year to date and Cathie Woods ARK Innovation ETF (ARKK) is down 60% year to date - why shouldn’t earlier stage, higher risk private companies have an even bigger haircut applied to their valuations?

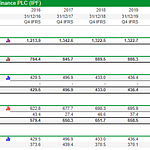

So, let’s for argument’s sake settle on an 85% cut from year-end 2021 numbers - where would that put the NAVs of the funds mentioned above? Here are the results below - Note I have not made an allowance for any cash held on the balance sheet which will, of course, make a difference:

- SuRo would be at $1.78 per share. The current share price is $3.84. BUT a huge bit of its current share price is cash. More on that next. Cash balance was $153m at June 30th versus market cap of $116m

- Augmentum. NAV would be at 23p. Current share price 93.5p. I think there’s about £31m in cash at the last year end to add back into these numbers.

- Chrysalis. NAV would be at 35p versus current share price of 58p. Remember that there’s a fair bit of cash on balance sheet here - £48m at the last count. My estimate of possible value is £260m vs current valuation of £350m

- Schiehallion. NAV Ords 19.5p. There’s a huge amount of cash from the C class shares, currently invested in Treasury Bills.

- Molten Ventures. NAV around 135p versus current share price of 303p. Year end cash was about £75m by my workings vs market cap of £464m. My estimate of possible value is £300m.

- Seraphim. NAV at 16p versus share price of 60p. 25% of Nav is in cash which I reckon is about £60m. Current market cap is £144m. My estimate of possible value is closer to £100m.

If my back of the fag packet calculations are right, then I think its fair to say that we have much further to go on these haircuts.

Take the poster child of this sector in the UK - Chrysalis. My finger in the air is that we won’t see trough valuations until the fund is worth circa £260m which would represent another 28% decline from the current market cap. That said, if I’m honest I think that Chrysalis is much closer to the ‘mark’ when it comes to valuations having already taken some big hits on the balance sheet.

By contrast, I think Schiehallion is woefully over valued and I also think that the Seraphim Space Investment Trust, despite its fantastic strategy - and excellent investments - is probably due another mauling, possibly involving another 30% reduction in the share price while Molten Ventures- another outfit I rate highly - is possibly due another 35% reduction in valuation.

In each of these examples above, I have also assumed that there is parity between the ‘trough’ Nav and trough ‘share price’ whereas history teaches is that in reality at the trough the shares will ALSO trade at discount to my 85% NAV hit.

Watch SuRo Capital

One fund vehicle does stand out in this analysis - US-based VC SuRo (Sutter Rock) Capital. This is in effect a US version of Chrysalis and at one stage was a venture-oriented business development company or BDC before it transformed itself into a pure-play VC.

Currently it has a portfolio of mid to late-stage tech businesses with online education platform Course Hero the biggest portfolio holding (worth $59.5m for 29.8% of the portfolio) followed by Forge Global Holdings ($21m and 10.6%) and Blink Health ($11.7m and 5.8%).

Cash at June 30th as $153m but we probably have to lop off that number roughly $13m for a recent tender offer for the shares plus running costs of the business.

There’s also an outstanding loan of 6% Notes due in 2026 worth $73m. Take off that loan, net out the share repurchases and I reckon the net worth of the business - assuming zero valuation for the portfolio companies - is about $65m, with around $125m to $130m in available cash. The current market cap of the business at $3.95 a share is about $120m. One other note - the fund has recently invested $10m in Series C preferred shares in WHOOP, a digital fitness and health coach business.

I like the fact that SuRo has all that cash swilling around. Assuming it doesn’t waste that capital on hair brained investment ideas, it should be in a brilliant position to invest in the next wave of startups once valuations are reset in the next year or so. Unfortunately, I don’t think that balance sheet strength is going to help SuRo in the short term - it will be perceived as vulnerable because of its focus on tech focused late stage pre IPO private businesses. I can see the share price declining to $3 a share during the next 6 to 12 months as the next stage of market sell off rolls into town. That would imply a trough valuation of less than $100m despite all that cash.

As for the UK listed VCs, I see an average 25 to 35% further fall in share price to get to ‘real world’ NAV parity, although I think there will be an overshoot on the downside of another 10 to 15% as funds continue to trade at a discount. That implies falls of between 40 and 50% from current levels.

I would also note that although these funds all hold a fair amount of cash I’m worried that they don’t have ENOUGH cash to be able to reinvest when the up cycle eventually comes. Only SuRo Capital seems to be well positioned to benefit from the next stage of the cycle as private valuations are slashed.

Share this post