The Shipping Forecast: the world according to TMI

This week we have another of our Adventurous Investor in Conversation podcast interviews, this time with Ed Buttery who is CEO of Taylor Maritime Investments. The TMI fund is one of my favourite funds at the moment and thus I was keen to catch up with Ed. The conversation is much more broadly about the whole shipping space rather than the fund itself and we talk about the following:

- Why the top line downward moves in the Baltic Dry Index aren’t relevant for all segments of the shipping market

- Why the bulk freighter market is holding up well

- Why building new ships in the handysize segment is so difficult

- Why China is importing huge amounts of food and how that is impacting ship movements

- Why the coming environmental challenges facing shipping are manageable

- The logic behind the proposed acquisition of Grinrod Shipping

Poll Results

Last week I ran my second readers poll - I wanted to understand investors’ views on cash. In part, it riffs off a Citywire column on the subject from last week - available HERE, where I make the point that once savings rates hit 4% cash becomes really attractive.

As I write this (Tuesday) there’s still a day to go but thank you for the 137 people who took part!

There doesn’t seem to be any consensus on whether to increase or decrease cash levels but what is striking to me is that 36% of readers had cash levels above 25%. That’s a much higher cash allocation than I would run at the moment and the number of investors with cash at that level is a real surprise to me.

Funding Circle

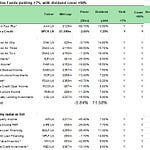

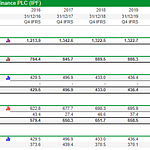

Only a short while ago I highlighted why I thought Funding Circle Holdings was worth investing in - I highlighted its challenges but felt the potential risks (especially a UK recession) was already in the price. Since then the shares have bounced back and we’ve also had the H1 results. These numbers were as expected - the highlights are below :

· Loans under management of £4.1 billion (31 December 2021: £4.5 billion) down 9% following expected early repayments of CBILS loans and PPP loan forgiveness.

· Originations of £803 million (H1 2021: £1.6 billion) down 51% year-on-year in line with expectations following the conclusion of the government-guaranteed loan schemes in H1 2021, but up on H2 2021 by 21%.

· Operating income of £66.4 million (H1 2021: £94.5 million) down by 30% against the high levels of income from the government-guaranteed loan schemes in H1 2021. H2 2021 included £14 million of deferred PPP revenue.

· Investment income of £10.9 million (H1 2021: £26.1 million) down by 58% as investments monetised in line with strategy and remaining loans amortise down.

· Fair value gain of £1.5 million (H1 2021: £8.1 million gain) following positive revaluations in both H1 and H2 2021, reflecting underlying credit performance.

· AEBITDA of £10.6 million (H1 2021: £53.3 million) and operating profit of £1.5 million (H1 2021: £35.5 million) in line with reduction in net income.

· Net assets of £299.3 million (31 December 2021: £288.0 million), including cash of £200.7 million (31 December 2021: £224.0 million) of which £183.4 million (31 December 2021: £199.4 million) was unrestricted3.

Arguably the most important bit of these numbers was the forward projection : the business says it has taken a ‘prudent’ approach “to the uncertain macro environment in H2 2022, with £15 million reduction to income outlook; now expected to be in the range of £140 million - £155 million.”

My guess is that in reality the revenues will be at the very bottom end of that range , probably around £140m which should prompt the management to even more aggressively cut back costs.

Personally I’d be looking to take a big slug out of marketing which consumes between 25 and 30% of income. Funding Circle also reaffirmed “that the business will be AEBITDA positive for the Full Year” - my guess is that that number will probably be in the low single digit millions. But there are some bright spots - the new products look like they are gaining traction and I stick with my base valuation case : the business has total net assets of £299m and unrestricted cash of £183m against a market cap of around £140m.

I still believe these undemanding numbers make Funding Circle a cheap buy for a much larger financial services business looking to own a forward-thinking fintech. I’d also note that both the CEO and CFO bought around £50,000 of shares each on the day of the results.

Corteva - the lean mean seed machine

Regular readers will know that I keep a close eye on new portfolio additions to the Arbrook American Equities fund managed by Robin Milway. The fund boasts an impressive track record in what is, I think, a very difficult and liquid market for active equity fund managers i.e mid to large-cap US equities. Over the last 3 years of the fund, for instance, its up 50.2% against 39.6% for the equivalent IA US equity sector. More importantly, Robin is an astute picker of sensibly priced growth-oriented stocks i.e he is a source of great stock picking ideas. This month he’s highlighted a leading player in the ag/food sector - Corteva.

Corteva has been on my food tech radar for some time. I haven’t bought any, largely because I have thought it a little overpriced. Unlike most food tech and tech-oriented stocks, its shares have gone up in value over the year to date, starting the year at $35 a share before hitting a peak just a shade below $64 a share. That said, even at these elevated prices the shares don’t trade at insane valuations - they are currently at 24.4 times forward earnings (not cheap but not expensive).

Average turnover growth for the last three years is a more modest 3.1% per annum and the return on capital employed is only 8.1% - I’d prefer that to be closer to 12%. Gearing is low and the business has $4 billion in cash. My biggest negative though has been that frankly anaemic sales growth number - the business seems stuck in the $14 to $16 billion revenue range. Maybe the current food crisis might be the boost this business needs to break out of that revenue range.

Here isRobin’s take on Corteva:

“…the globally leading provider of modified seed and crop protection chemicals - announced it was to free itself of non-core businesses and right-size its cost structure (again). Since Corteva was born from the merger of Dow and DuPont’s agricultural businesses we estimate it has already removed costs of around 4% of revenues by way of synergies and restructuring.

“ It does highlight just how different current CEO/CFO team of Chuck Magro and Dave Anderson operate compared to the previous team that we would have described as somewhat “sleepy”. Earlier this year the company announced it was moving its headquarters from legacy location of Wilmington, Delaware, to Indianapolis, Indiana. We are attending Corteva’s Investor Day in Iowa this month which should prove valuable as we expect more information on the changes taking place behind the scenes. An indicator of the company’s evolution is the success it has had in soybeans.

“For two decades fierce rival Monsanto (now Bayer) dominated the soybean seed market in the US. Corteva introduced a rival product Enlist E3 in 2018 to challenge Monsanto’s Xtend and in August Corteva announced Enlist was planted on 45% of all US soybean acreage. In the second quarter soy was 1/3 of seed revenues.

“We see this as an important achievement as it is a major step in Corteva’s transition from being predominantly a corn seed player to having a diversified portfolio of products. On the earnings call Magro also mentioned how issues with Bayer’s herbicide dicamba was leading to higher uptake of Enlist. While Bayer’s problems with Monsanto since the acquisition in 2016 is not core to our latency thesis on Corteva, it certainly does no harm. One observation we would make is that we believe in a world that is attempting to use less fertiliser, the need for higher yielding seed varieties is critical. The European Union has committed to reducing inorganic fertiliser usage in the block by half by 2030 as part of its Farm to Fork strategy.

“Canada intends to reduce fertilizer usage as a means to decrease emissions by 30% by 203010 . Sri Lanka is an example of what happens when fertliser application is reduced. In 2021 the Sri Lankan government banned the use of chemical fertlisers and this led to a devastating collapse in crop yield. Ironically, Europe’s energy crisis looks like it will bring about the drop in fertliser usage sooner rather than later. Fertlizers Europe currently counts that “over 70% of European [fertiliser] production capacity has been curtailed” 12 due to high natural gas prices. We suspect the words “crisis” and “food” will sadly be heard together frequently for some time.”

At this stage, I have to say that I’m not entirely convinced by these arguments - the past financial track record especially with regards to sales growth is a little underwhelming. There’s a lot of talk about structural change and I have no doubt that if that change does speed up and gain traction, then the share price could move even faster. For now though, the recent rally in the share price looks a bit too rich for me and I’ll carry on researching the stock and the sector.

Share this post