Investment ideas for the next few quarters

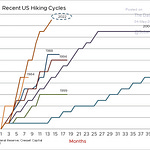

The latest episode of my regular podcast - Adventurous Investor in Conversation - is a 30-minute spin through key market signals to watch out for in Q4 22 and H1 22. My podcast guest is the technical analyst and Tricio strategist Gerry Celaya. Over 30 minutes we talk about:

1. What next for Russia and Ukraine

2. Why oil prices could collapse as low as $65 a barrel

3. Why gold is a busted flush and could fall sharply, perhaps testing $1300

4. The FTSE 250 could fall sharply but then recover fast

5. The cable rate £ / $ looks volatile with sterling especially vulnerable- we could even see parity with the dollar at some stage

6. Watch government bond yields both at the 2 and 10-year level. Once they get above 4% it might be time to switch back into bonds

7. Hedging bond fund probably makes sense

For the record, both of us are still fundamentally bearish and I would agree with all the points/barriers discussed above.

Reader Poll

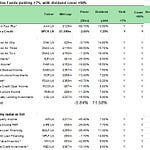

My column in Citywire this week focuses on the growing attraction of cash as an asset class. I’m interested to know what newsletter subscribers think about cash as an asset class - I have two questions, one related to the direction of cash in portfolio terms, the second to the relative level.

The poll will remain open for 1 week

whither the FTSE 250?

One of Gerry’s core contentions is that the FTSE 250 index – a useful indicator of UK economic sentiment – could sink ever lower as the UK economy deteriorates super fast. I agree but I also think that at some point, all that horrible sentiment becomes embedded in the price. My own feeling is that another 10 to 15% decline is possible.

But we also need to balance against this the reality that if the FTSE 250 becomes a symbol for the UK economy, then that makes UK PLC bloody cheap – and vulnerable to M and A activity. That’s the point rammed home by Nick Lawson at Ocean Wall who reminds us that the FTSE 250 is currently trading on a PE of 10.5x, which compares to 20x for the S&P and 13.6x for the Euro Stoxx 600.

“So, the index looks exceptionally cheap vs the US and cheap to Europe. However, it is important to remember that the UK market has a very global makeup with >50% of sales generated ex-UK. It is no wonder that UK businesses are attractive to a broad number of acquirers, with the FTSE 250 a particular focus given the greater dynamism among the constituents, as well as being a more manageable size. The FTSE 250 is now trading below its Euro crisis 2012 10-year low and recent post-Covid 2021 high of 17x”.

Odds and Sods - Harbourvest

I’m still fairly cagey about immediate prospects for listed private equity. I think it is looking cheap and especially like the look of Oakley Capital but I also think that prices could go even lower. Another of my favourite stocks is HarbourVest Global Private Equity (HVPE), a FTSE 250 investment company with global exposure to private companies. Analysts at Peel Hunt have just initiated coverage of this listed PE fund, which they reckon is oversold on a 44% which they reckon is at a “rare level”. I agree but think that that discount could get even bigger – possibly pushing past 50%.

Here's the Peel Hunt summary note:

· With c 1,000 material underlying holdings, it provides significant diversification by geography, private equity stage, phase and strategy

· It aims to deliver material outperformance of public markets over the long-term and has a strong track record of doing so (annualised NAV total return of 21% over last five years to date makes it the top performing trust in the Private Equity Funds of Fund sector, outperforming the peer group average by 4% per annum.)

· It provides investors with exclusive access to:

o the best private equity managers and strategies – usually the preserve of the world’s biggest, smartest institutional investors; and

o short cuts challenges of oversubscribed funds need for large commitments, and waiting several years for the realisation period.

· HV is an expert in picking managers who invest early in big “winners” and future trends (they’ve had exposure to all the big stories of the last 15 years – Facebook (they made 300x), Uber, Snowflake, Coinbase, etc)

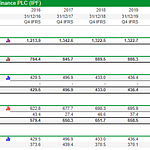

· HVPE’s balance sheet is strong - FY results to 30 Jan 2022 saw positive net portfolio cash flow (+$320m) and the company has c. $1,050m of cash and credit facility. Credit facility of $800m remains undrawn

Odds and Sods 2 – Digital Platforms

Interesting industry research note on the emergence of digital content platforms from analysts at Killik and Co. Two highlights I’d pick out:

· Short-form video is an especially interesting opportunity for the industry, with music now increasingly a core component of the user experience on social media apps such as TikTok, Instagram, and Snapchat. According to SensorTower, since its launch in 2017, TikTok has been downloaded more than 3.5 billion times (the only app not owned by Meta Platforms to surpass that milestone), while a 2021 report by the IFPI states that of the 5.6 hours per week spent on the platform on average, 3.9 hours are spent watching videos where music is a key part of the viewing. Additionally, whereas previous generations may have used the radio or MTV as a source of music discovery, Gen Zs and Gen Alphas will increasingly hear a song for the first time on social media (including tracks released decades earlier), before listening to the specific track on a streaming service.

· In our view, the biggest beneficiaries of these trends will be the music labels and publishers. The top three labels, Universal Music Group (UMG), Warner Music Group, and Sony control c.70% of the recorded music market and 60% of the music publishing market. This dominance allows these companies to capture between 60%-70% of the global music revenue pool. We believe that UMG, as the largest recorded music company and home to many of the world’s most popular and influential recording artists, including Taylor Swift, Justin Bieber, and Kendrick Lamar as well as the owner of the rights to iconic catalogues including those from The Beatles, The Rolling Stones, and Bob Dylan, is particularly well positioned. The company’s superior scale enables it to drive a higher share of listening time than the rest of the industry on traditional streaming platforms as well as the emerging platforms. In addition, UMG has an unrivalled track record of breaking artists as well as a deep and broad music catalogue, which we believe will enable it to continue to take an outsized share of the revenue pool in the future.

Share this post